The Bank of Sierra Leone has approved the Rokel Commercial Bank Statements of Account – revealing a staggering NLE191, 627, 038 (One Hundred and Ninety-One Million, Six Hundred and Twenty Thousand and Thirty-Eight Cents) for the 2023 Financial Year.

Profit after tax is Nle142,802,319, eclipsing the NLe69,48,024 the previous year.

This significant achievement represents a 104% increase from the NLe94 Million recorded in 2022. Consequently, customer deposits rose to NLe2.9Billion indicating a 25% increase from NLe 2.35Billion recorded in 2022.

The growth in deposits has triggered a significant growth in the bank’s balance sheet from NLe3.2Billion in 2022 to NLe3.8Billion in 2023 representing a 18.75% increase respectively. Total earnings per share also grew from NLe0.76 per share (2022) to NLe1.56 per share (2023).

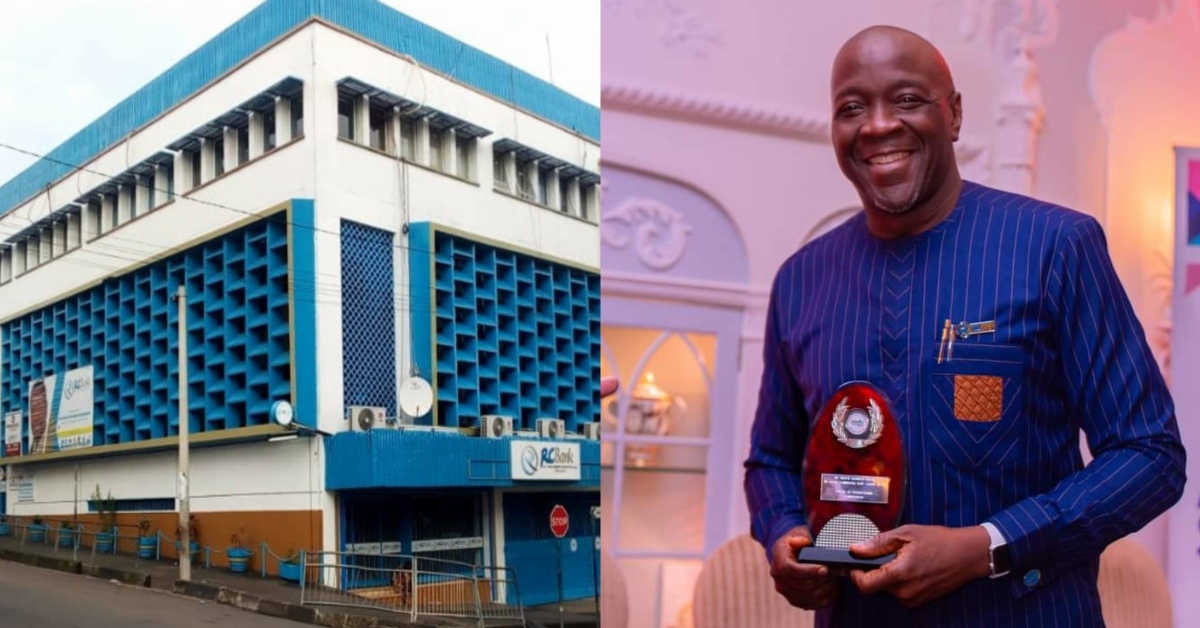

In September this year, the RCBank Celebrated its 25th Anniversary after a smooth transition from Barclays Bank Plc in 1999 which had operated the bank for nearly a century.

The celebrations were marked by several indoor and outdoor activities including Christian and Muslim thanksgiving services and a special event to recognizing staff who have had 15 to 35 years of unbroken record of service.

In each of these events, the Managing Director, Dr Walton Ekundayo Gilpin re-echoed a renewed sense of hope and commitment in expanding and making Rokel Commercial Bank a dominant force in the subregional finance industry.

2 Comments

2 Comments

[…] Source link […]

[…] Source […]