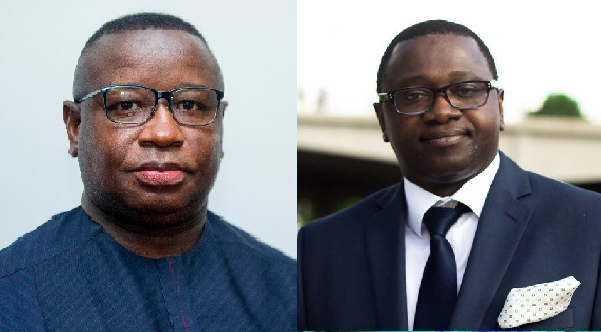

The Minister of Finance, Ahmed Fantamadi Bangura, has disclosed that in 2025, the government of Sierra Leone will not introduce any new tax but will work towards improving the effectiveness of tax administration and collection.

The Minister made this disclosure during the presentation of the Finance Act 2025 in parliament on Thursday, 14th November 2025.

Minister Ahmed Fantamadi Bangura noted that the Finance Act is critical in the government revenue mobilisation drive.

He stated that after the rebasing of the GDP of Sierra Leone from around four billion dollars to around eight billion dollars, the DGP to domestic revenue ratio needs to be improved from around 8.9% to around 10%.

Among the key issues in the Act are introducing the filing of payroll tax returns and penalties as requirements for all employers, penalties for non-filers, late filers and late payment of excise tax, redefining the classes of taxpayers (Large, Medium, Small and Micro Taxpayers), relative to their turnovers, introduce a penalty for failure to file an income tax return, revise the royalty rates on dimension and other stones based on value-: US$25 per metric ton or US$500 per 33.2 cubic metres container for all stones other than dimension stones and marble; and US$50 per metric ton or US$1,000 per 33.2 cubic metres container for all dimension stones and marble and others.

After several debates and discussions, members of the parliament unanimously enacted the 2025 Finance Act with some amendments, such as deferring the 5% import duty on rice importation in the 2024 Finance Act, which was due in 2025 to 2026 January.