The Public Accounts Committee (PAC) convened a critical session at Parliament House’s Administrative Building to address the escalating issue of outstanding Goods and Services Tax (GST) arrears for the fiscal year 2021. The session focused on the persistent challenges of tax compliance and the significant impact of these arrears on national revenue.

During the meeting, committee members expressed deep concerns over the increasing number of taxpayers failing to settle their GST obligations. This non-compliance has led to substantial revenue losses for the government, a situation the PAC is determined to rectify.

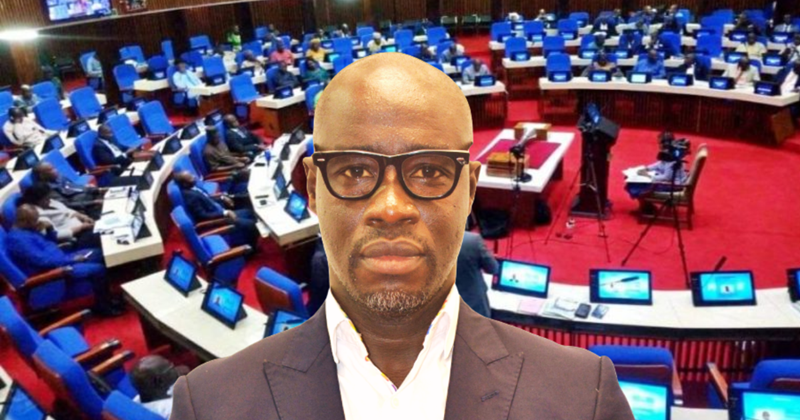

Deputy Speaker of Parliament and PAC Chairperson, Hon. Ibrahim Tawa Conteh, underscored the urgent need to enforce accountability among defaulting taxpayers. “We cannot allow individuals or businesses to evade their tax responsibilities,” Hon. Conteh asserted. “This not only undermines the integrity of our tax system but also hampers our ability to fund essential public services.”

Hon. Conteh elaborated on the PAC’s rigorous approach to addressing these arrears, emphasizing fairness in the process. The committee meticulously reviews each case to ensure that taxpayers are not wrongfully flagged for payments they may have already settled. “We want to create a fair platform where taxpayers, if owing the National Revenue Authority (NRA), should pay, and if not, they should provide documentation to support their claim,” he explained.

Since the last PAC meeting in July, the committee has extended the initial 10-day deadline to allow for a more comprehensive reconciliation process. In collaboration with the NRA and the Audit Service, the PAC has developed specific metrics to identify taxpayers still in debt to the government.

“As a committee, and by law, we are prepared to garnish accounts to recover the owed funds,” Hon. Conteh warned, while also reaffirming the PAC’s commitment to ongoing engagement to ensure transparency and fairness throughout the recovery process.