Rokel Commercial Bank (RCBank) has become the first commercial bank in Sierra Leone and the Mano River Union to adopt and fully integrate the Pan-African Payment and Settlement System (PAPSS).

This innovative platform is set to transform cross-border payments within Africa, supporting the African Continental Free Trade Area (AfCFTA) and advancing financial inclusion across the continent.

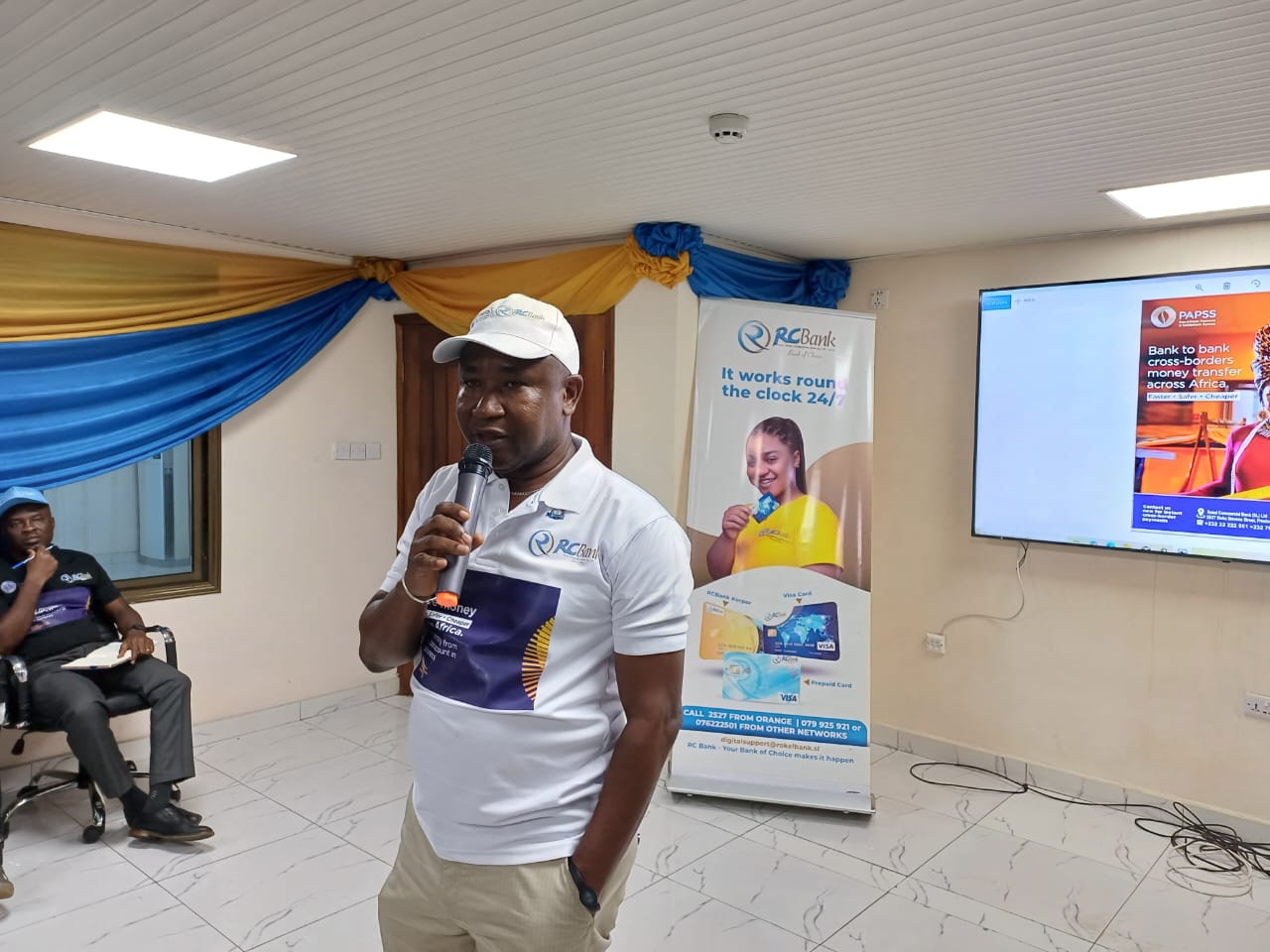

The launch event, held at RCBank’s Eastern Police/Clock Tower Branch, featured presentations by senior bank officials, including the Credit Risk Director Millicent Cole and Head of Operations Adikali S. Kamara.

The event highlighted PAPSS as a seamless and efficient payment system that enables instant cross-border transactions in local currencies.

PAPSS is designed to create a highly effective international payment system, eliminating the need for African traders to convert local currencies into international ones such as USD or EUR.

According to Millicent Cole, PAPSS streamlines cross-border trade by allowing customers to transfer funds directly in their local currency.

“This system ensures that someone in Sierra Leone can send money in Leones to any part of Africa without the need for currency conversion,” Cole explained.

“It’s fast, reliable, and designed to make intra-African trade more efficient, cutting out unnecessary delays and costs.”

Cole further noted that PAPSS operates with the involvement of central banks from participating countries, ensuring its robustness and reliability.

Adikali S. Kamara outlined how PAPSS benefits Sierra Leone’s economy and its people. “This platform simplifies the transfer of funds across borders, whether for businesses or individuals. It’s not just for the financial sector—anyone can use PAPSS to send or receive money within Africa in a matter of seconds,” Kamara said.

Kamara added that PAPSS is a strategic initiative by the African Union to strengthen economic integration, making it easier for Sierra Leoneans to participate in trade and other financial activities across Africa.

PAPSS operates on three core processes: instant payment, pre-funding, and net settlement. Transactions are processed within 120 seconds, making it one of the fastest systems for cross-border payments. By conducting compliance, legal, and sanctions checks instantly, the system ensures security and transparency in all transactions.

Previously, cross-border payments required funds to leave Africa for conversion before being transferred to the recipient bank, adding days to the process. With PAPSS, such delays are eliminated, paving the way for efficient trade and economic growth across the continent.

Rokel Commercial Bank’s Managing Director, Dr. Walton Ekundayo Gilpin, has been a key advocate for PAPSS in Sierra Leone. As a member of the PAPSS Working Group formed in May 2024, Dr. Gilpin has played a critical role in promoting the adoption of this transformative payment system.

“PAPSS is a game-changer for Africa. It facilitates financial inclusion and makes the vision of a unified African trade area a reality,” Dr. Gilpin remarked during the launch.

The introduction of PAPSS aligns with Rokel Commercial Bank’s commitment to innovation and its role as a leader in Sierra Leone’s financial sector. By reducing transaction costs, increasing payment speeds, and eliminating currency conversion barriers, PAPSS empowers businesses, fosters trade, and drives economic growth across Africa.

With this launch, RCBank has solidified its position at the forefront of Africa’s financial transformation, contributing to the realization of a more integrated and prosperous continent.