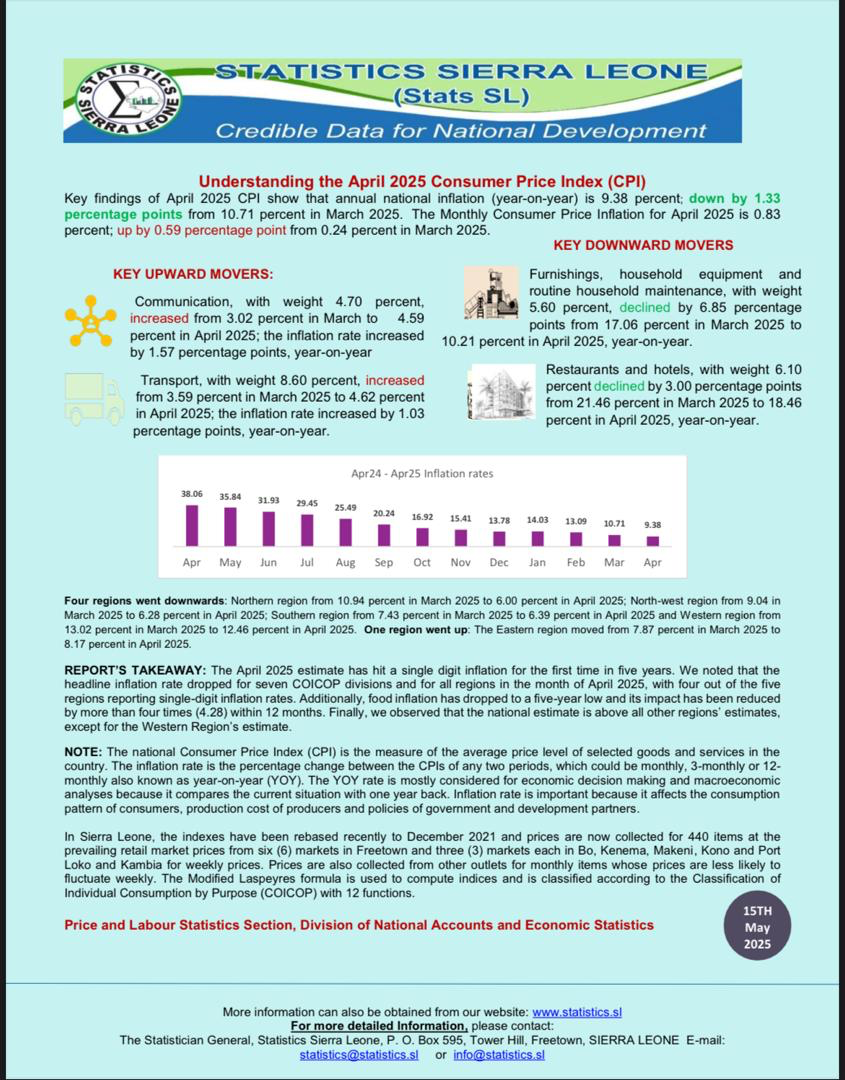

Sierra Leone has recorded a significant economic milestone as its annual national inflation rate (year-on-year) for April 2025 declined to 9.38 percent.

This marks the first time in nearly four years since May 2021 that inflation has fallen to single digits. According to the latest Consumer Price Index (CPI) bulletin released by Statistics Sierra Leone, the drop represents a 1.33 percentage point decrease from the 10.71 percent reported in March 2025.

The monthly consumer price inflation for April 2025 also increased moderately to 0.83 percent, up from 0.24 percent in March. This reflects modest month-to-month price rises across selected goods and services.

Key contributors to the downward inflation trend include a substantial decline in prices for furnishings, household equipment, and routine maintenance, which fell by 6.85 percentage points, dropping from 17.06 percent in March to 10.21 percent in April. Similarly, the restaurant and hotel sector saw a 3.00 percentage point reduction in inflation, decreasing from 21.46 percent in March to 18.46 percent in April 2025.

Despite these reductions, some categories experienced upward price pressures. Communication costs, with a weight of 4.70 percent, rose from 3.02 percent to 4.59 percent, while transport costs, which carry an 8.60 percent weight, increased from 3.59 percent to 4.62 percent.

Regionally, four out of five regions in Sierra Leone reported declining inflation rates. The Northern Region saw the most significant drop from 10.94 percent in March to 6.00 percent in April. The Eastern Region was the only area to record an increase, moving from 7.87 percent to 8.17 percent.

Statistics Sierra Leone highlights that food inflation has now dropped to a five-year low, reflecting improved food supply and reduced pressure on household incomes. The national estimate is also consistent with data from subnational areas, signaling broader economic stability.

This achievement indicates a positive outlook for Sierra Leone’s economy and offers hope for sustained inflation control through sound fiscal and monetary policies.

This can only take effect on paper, but not on our daily dealings

A practical example is on the the price of fuel, etc

So it’s meaningless if this chance(decrease in inflation) can not affect our data to day dealings