The University of Sierra Leone (USL) is embroiled in a financial scandal after losing a staggering US$4.5 million in a failed Public-Private Partnership (PPP) with a Nigerian company.

The funds, intended for a new campus project, were advanced despite numerous red flags, raising serious concerns about oversight and governance within the institution.

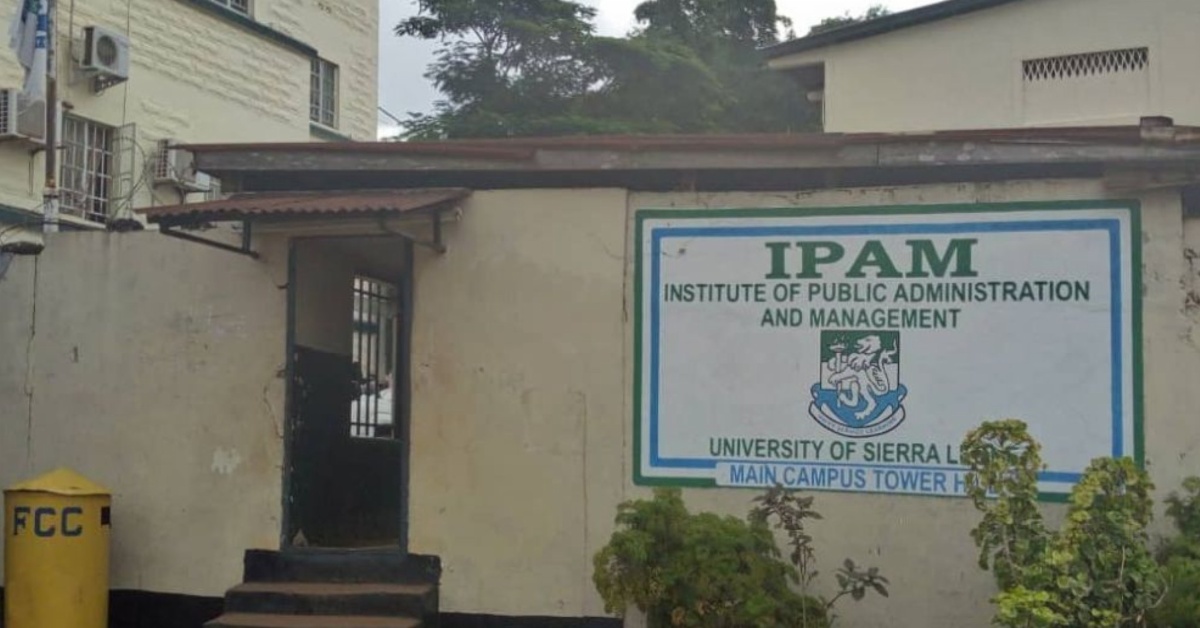

The project, which began in 2017 with high hopes of constructing a US$50 million campus for USL’s Institute of Public Administration and Management (IPAM) at Bureh Town, quickly unraveled when the Nigerian developer, Femab Properties, failed to deliver on its commitments. Despite clear warnings from senior financial officials, USL proceeded with the payment, bypassing essential safeguards that could have prevented the loss.

Abandoned development site at Bureh Town

The deal, which was originally celebrated with fanfare at State House and endorsed by the Sierra Leonean Parliament, has now become a cautionary tale. Financial Secretary Sahr Jusu had raised significant concerns about the contract, highlighting the absence of a guarantee for the advance payment and the vague terms of the agreement. However, these warnings were ignored, and the university transferred the funds to Femab, only to be left with an abandoned site and no recourse for recovering the money.

The Bureh Town campus site after five years after work stopped

The scandal deepened as it emerged that the university had kept the loss secret, only coming to light after investigative inquiries. Efforts by USL’s Vice-Chancellor to retrieve the funds have been met with silence from Femab, and the project, which once promised to enhance Sierra Leone’s educational infrastructure, now lies in ruins.

This debacle highlights the dangers of overriding financial safeguards and the consequences of insufficient due diligence. The situation also raises questions about accountability within the university’s administration and the broader implications for public funds in Sierra Leone

Source: Andrew Weir and Africa Confidential

Who in his/her right senses will ever trust a Nigerian or a Nigerian institution? Nigerians are notorious stammers worldwide. Why and how did the University of Sierra Leone get itself involved in this sort of transaction? The University administration should be ashamed of itself. Little wonder they have been trying to make the whole saga a secret. And these are the very people who will turn around tomorrow and start shouting and blaming the government for not promoting educational ideals.

hmm uh🤔

Bypassing the deal with Sierraleonean paved the way for Nigerian scammers.

Congratulations to the Nigerians

If and only if this report is true then this is what we called practical inconsistency in critical thinking the university and also the government of Sierra Leone failed to critically understudy the project and know how authentic the partnership is. Such fraudulent act has always been happening and I’m afraid if our leaders can’t handle situations like this. And I guess there are Sierra Leoneans who have verse knowledge on the engineering field they should’ve been the people who will handle this project and the Nigerians should be behind for backup instead of given them the whole project for them to manage. The issue of Sierra Leone is, they value foreigners than the citizens. We must learn the culture of putting our citizens Infront of work instead of they been behind the foreigners which is undone. Countries like south Africa they will never put a foreigner infront of any job irrespective of their ability and their status they are always working under the citizens which a very good practice.

Those who approved the deal should be investigated. That they insisted on going forward with such a deal means they were in on the scam. Even if it turns out they were completely duped, they need to be fired since they were given warnings and choose to ignore it. And there are means to go after the company, Sierra Leone needs to get the help of the Nigerian government, at the very least, sue them in Nigeria, this does not need to go buff.

Are Nigerian people really God fearing people? It’s true that the university did a sad mistake by awarding a contract of that nature to foreigners instead of citizens, but it’s a very big shame to the Nigerian company.

This is Sierra leone

What is wrong with competency of Sierra Leonean engineers… you people are part of the deal … am very sure that money has been shared amongst you all … with all the advices and warnings.. you ignore it all and go ahead and do payment… this is not professionally done .. as long as the contract has been awarded to them … they should have done some percentage of the work and then payment… it’s must have been a pre finance procedure .

Why not using sierraleonean Engineer’s now see what has happened with the too much trust in foreigners. Again certain people might have balance the system for their own selfish desires

O mama salon where are we heading to for allowing a Nigerian company to go with these huge amounts without doing the appropriate work, with no iota of doubt to have the administration of USL to blame as we expect much from them .

Foolishness to the high degree.

Oh mama salon! Where are we heading to?

If this is true, it would be a nasty big slap to the educative fools. I actually don’t want to believe this story with my brain.

This is really unbelievable to hear!

A campus that supposed to have housed us in our final year has today become a cautionary tale.

I wondered how this happened! A whole U S L, big institutions can’t understand the risks involved by bypassing critical procedures of awarding a contract. What you guys are lecturing? This is a big shame on the U S L.

I don’t really believe this, maybe it’s because Nigerians are known to be scammers that is why they mentioned Nigerians company. What is the name of the company? Which part of Nigeria the company based. Do we also know that our country (Sierra Leone) has notorious scammers. For me it’s a bravo to Nigeria if this is true and a very big shame Sierra Leone. This is not just done to the ordinary man but a university that is producing people of trust now how can we trust there trusts?

Iam very disappointed at the entire USL board members, it’s a shame to the country.

For heaven sake with all the so called Professionals and Financial Analysts they have, they cannot detect the risk and possible failure involved in this deal?

This matter is worth investigating. I doubt it if this money wasn’t embezzled by the so called heads of USL.

May God help Sierra Leone but the sad news are too much.

I wonder how this scam comes about, with all the brains surrounded in that USL sector especially when it’s comes to IPAM ! I rest my case

It’s a big slap to the university trust me guys they knew about the money let them refound it back what a shame. Sierra Leoneans we are too selfish instilled of our brothers they think of out siders that money has been shared among themselves let them stop fulling the public guys give back the money it’s not yours it belong to the people of Sierra Leone.

Awarding contract to foreigners is not a crime

My only disappointment is the company that compromises her integrity

It really bad that I wouldn’t have want to discussion on this cuz it is a plotted issues trust.

It only it it a well known and registered company to do such ask with the thinking of impunity

Twrrrrrrrrr

They certified us as engineers

But still they don’t believe us.

A very big shame to the educational sector of Sierra leone. 🤣🤣

The University betrayed our brothers sierra Leoneans who were competent to do the the job hatred

Why generalize that Nigerians are scammers? There are well over 8 Nigerian Banks in Sierra Leone , why have they not stolen public funds ?

So pathetic when so small minded people go public without getting the full facts

University of Sierra Leone should examine themselves , come out and say the truth.

There are criteria to meet before disbursement.

Someone should get fired but I bet nobody will.

Why accuse and insult all. Nigerians?

Imagine a university that have trained

A lot in to civil engineer is been scammed by a Nigerian