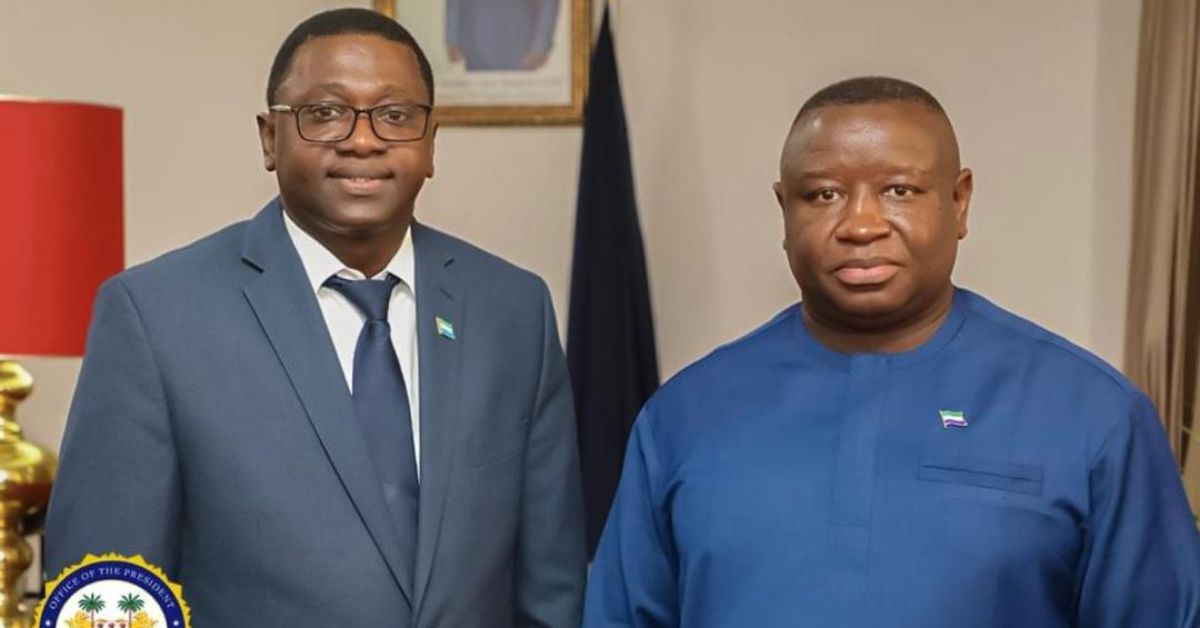

In a move that many Sierra Leoneans have sadly come to expect, President Julius Maada Bio has signed the Finance Act 2024 into law.

This new bill, passed by Parliament, is supposed to help boost government revenue.

But for most of us, it feels like just another way to drain our already thin wallets.

The Act’s new taxes hit where it hurts the most: our daily lives. Rice, which is the main food for almost every Sierra Leonean family, now has a 5% import duty.

And next year, this will double to 10%. It’s as if the government thinks we can suddenly grow enough rice to feed the nation within a year.

If not, well, we’ll just have to deal with more hunger.

If you’re hoping to build a home, think again.

Cement now has a 20% import duty hike, making it even harder to afford.

The same goes for iron rods, which are now taxed 10% higher. It’s becoming almost impossible for ordinary people to build anything, let alone dream of a better life.

Even cooking gas, something most families need daily, now has a 5% import duty increase.

So, if you’re struggling to make ends meet, cooking a proper meal will be even more difficult.

For businesses, there’s a tiny bit of relief.

The Minimum Alternate Tax (MAT) has dropped from 3% to 2%.

But before you celebrate, the Act introduces a 15% Withholding Tax on dividends, management fees, and lottery winnings.

That means even if you’re lucky enough to win the lottery, the government will take its cut before you even get to enjoy your prize.

The Finance Act also adds a 1% Education Levy and raises taxes on contractors—6.5% for residents and 11.5% for non-residents.

Sure, education is important, but this just adds more weight on businesses that are already struggling to survive in the harsh economy.

And for those who hope to win big through gambling or betting, think again.

The Act adds a 10% tax on gambling and lotteries, taking a bite out of the few joys that desperate people have left in these hard times.

Yes, there are some exemptions for machinery in the agriculture and manufacturing sectors, but let’s be real—most Sierra Leoneans won’t benefit from that.

For the average person, these changes feel like more pain, not progress.

This Finance Act isn’t a solution to our economic problems—it’s more like a test to see how much suffering we can handle.

It seems the government would rather push us to the brink than try to ease the pressure we’re under.

What’s even more concerning is that while these tax increases are clearly outlined, there’s very little transparency about where this additional revenue will go.

What specific public services or programmes will benefit from these funds?

Are the revenues from these taxes going towards infrastructure, education, or healthcare improvements?

Or is it simply going to finance the wages of an increasingly bloated government packed with loyalists?

These are the questions that remain unanswered.

If people sees tangible benefits from the taxes they are paying, they might be less likely to complain.

But all too often, it feels as if this money disappears into thin air, with no clear impact on the everyday lives of citizens.

So, as we carry on under these new taxes, the question remains: how much more can the people take?

This Finance Act 2024 may be seen by some as necessary for reform, but for most of us, it feels like just another heavy burden we didn’t ask for and can’t afford.

Another day, another tax, another struggle.

For the people of Sierra Leone, it seems the light at the end of the tunnel is still a long way off.

This government is a real mess

God will punish them for the suffering they are suffering us 😭😭😭

Hmmmm ooh salone

Ooo paopa salone for beteh! Pa after you na low battery sir !

God will continue to punished those greedy and corrupt politicians who derived joy in causing pains and sufferings to the people of Sierra Leone.

Another day, another tax, another suffering

Papay na for wok once na for the betterment of dis country

My question is, that is the lay man going to benefit

Man den dey see the pain, dey make lek dem blind..

WETIN AR WAN TOK SEF