What is an Electronic Cash Register? An Electronic Cash Register is a system designed to enable product to be sold at a retail outlet. Electronic Cash registers help large retail outlets track sales, Minimize register errors, collect inventory data and much more.

WHAT ARE THE FEATURES OF FEATURES OF ELECTRONIC CASH REGISTER?

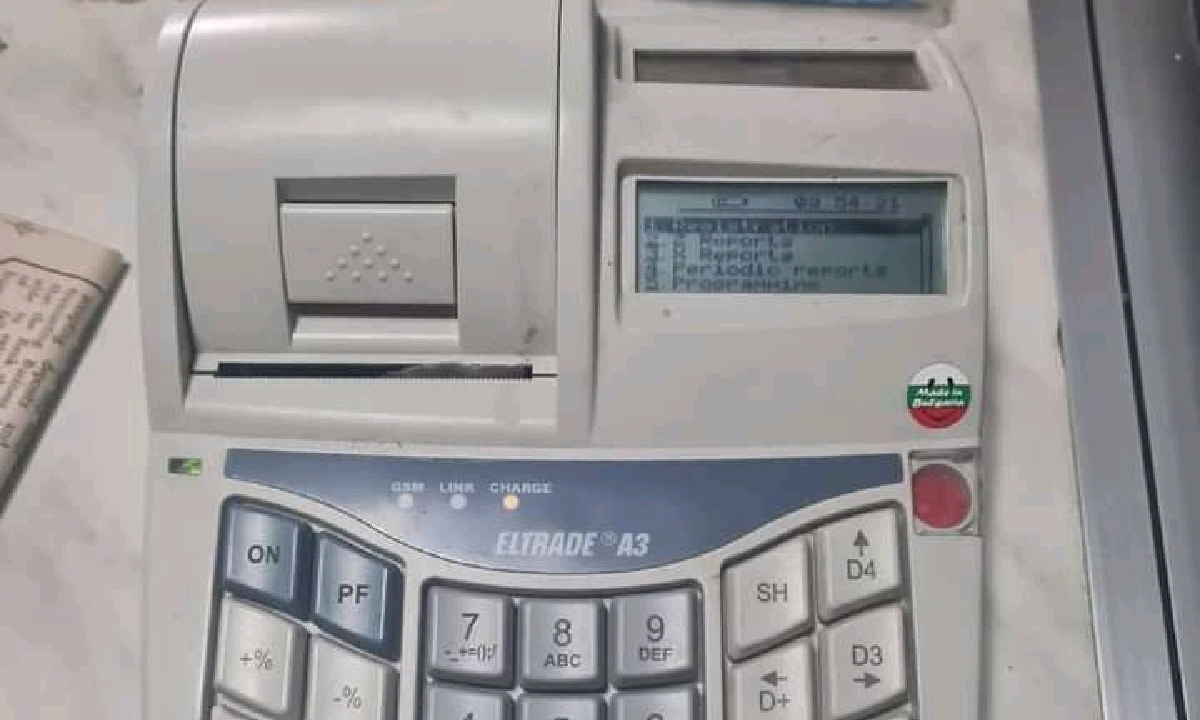

Electronic Cash registers consists of a cash drawer, a small display screen and buttons the cashier can press to add up amounts , assign sales to particular departments and calculate change. The registers will also print a basic receipt.

Buisness should not complicate themselves with POS AND ECR . Let me help to explain the difference a cash register and POS?

A cash register is a Machine that stores your cash in a drawer and let’s your facilitate the checkout process. Meanwhile, A POS, system can do that and help you rental buisness. The biggest difference between Electronic Cash Register and POS system is that the latter is so much more powerful , robust and features rich.

Meaning of POS, is Point -of- Sale. This system used to refer to the cash register at a store. Today, modern POD system are entirely digital, which means you can check out a customer wherever you are.

In case scenario for Sierra Leone, POS is not applicable! I stand to be corrected by authorities of NRA in the GST Section. He further pointed out that What the NRA have implemented here is ELECTRONIC CASH REGISTER (ECR) MACHINE FOR GOODS SERVICES TAX(GST) to registered buisnesses in the country.There’s no different from the latter, they only differences here’s that this new version is an electronic system to register Buisnesses for GST.

In 2019 the then Former government introduced GST( Goods and Services Taxes(GST). The collecting GST was so boring and time consuming.

The ECR Machine (The electronic Cash Register) which the NRA is installing to every GST registered buisnesses is just serving the same purpose to the manual paper GST Receipt system. Sincerely, speaking the ECR Machine have accepted the PAPER GST receipt book system , then why not do the same for the Electronic Cash Register Machine system. What buisnesses have used to enter into the manual receipt book for GST Register, the same is now applicable for the electronic Cash Register Machine.

Post a comment

Post a comment