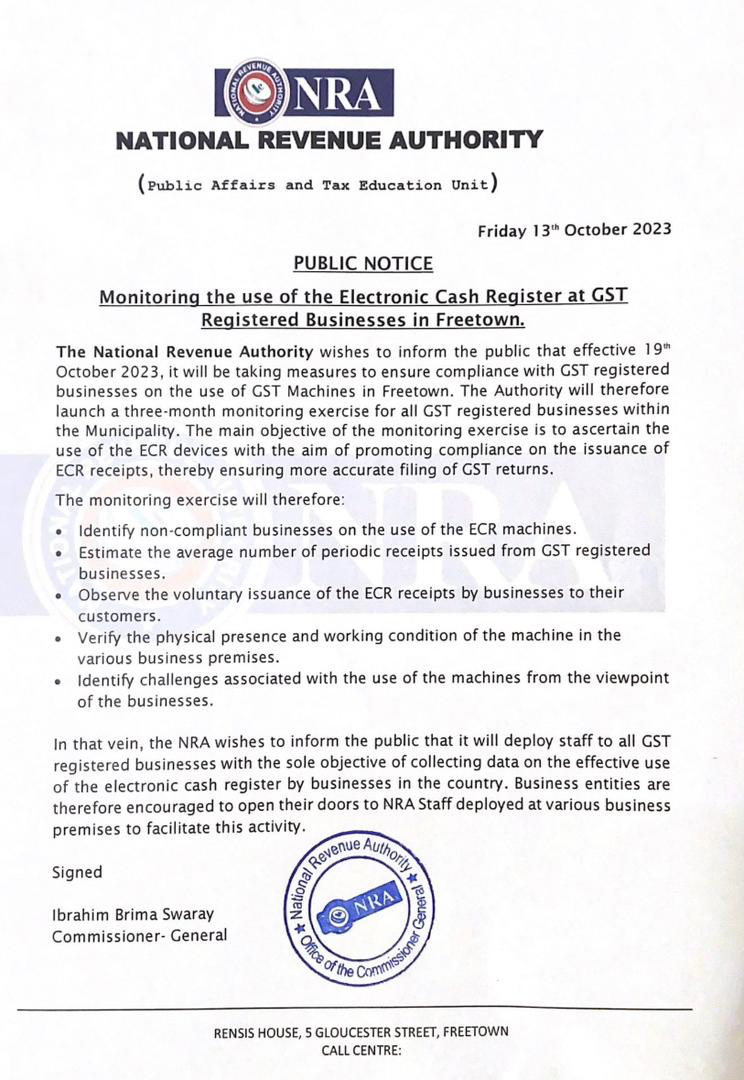

The National Revenue Authority (NRA) has rolled out a substantial three-month initiative for monitoring Electronic Cash Registers (ECRs) in GST registered businesses within Freetown.

This extensive effort is geared towards improving compliance and precision in ECR receipt issuance, thereby enhancing the accuracy of GST returns.

The key objectives of this monitoring initiative encompass:

- Identifying businesses that may not be complying with ECR machine usage.

- Estimating the average number of periodic receipts issued by GST-registered businesses.

- Observing voluntary ECR receipt issuance to customers by businesses.

- Verifying the presence and operational status of ECR machines in various business premises.

- Addressing challenges associated with ECR machine use from a business perspective.

In pursuit of these goals, the NRA will deploy its personnel to all GST registered businesses within the Municipality. Their primary task will be to gather data on the effective utilization of electronic cash registers by local businesses. The NRA extends an invitation to all business entities to collaborate and facilitate this critical endeavor by welcoming NRA staff during this period.

This comprehensive monitoring initiative highlights the NRA’s dedication to bolstering tax compliance and promoting precise financial reporting within Freetown’s business community.

The official notice reads below:

[…] Source link […]