The Bank of Sierra Leone had released the 2024 Financial statements of Rokel Commercial Bank and the figures show an unprecedented growth amidst growing competition and external shocks in financial markets

The biggest achievement for the bank is the massive leap from Le91.4 Billion (old Leones) to Le274.4 Billion (old Leones) indicating a 200% increase in share capital. This massive increase has come on the back of a Le192.8 Billion profit before tax and a Le143.9 Billion (old Leones) Profit after tax.

Whilst loans and advances grew by 33%, customer deposits grew by a significant 13% (Le3.3 Billion) from 2.9 Billion in 2023. Whilst shareholder equity also increased by 33% (951.5 Billion), loans and advances amounted to Le702.2 Billion.

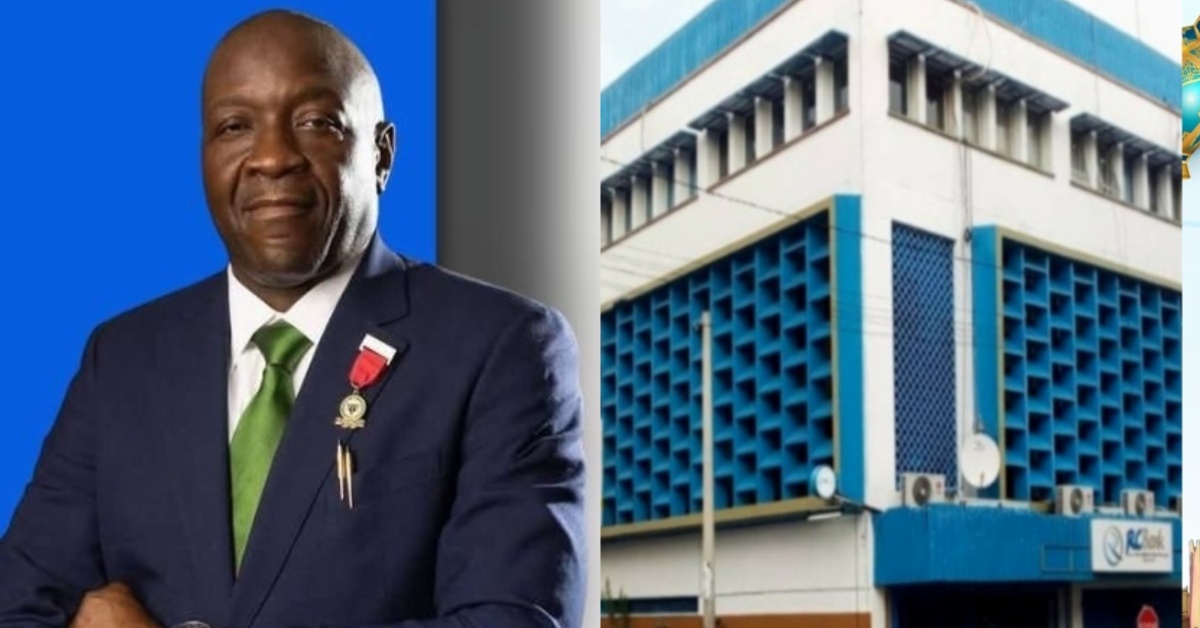

As the Bank gears up to its Fifty-Second Annual General Meeting on Tuesday 20th January, it is clear that the steady nature that has characterized its growth trajectory over the last couple of years has been premised on focused leadership. It could be recalled that in 2024 when the bank of Sierra Leone set a minimum capital requirement of Le274, 455, 866 Billion for all commercial banks by the end of 2027, the Rokel Commercial Bank was the first to meet that threshold the same year (2024).

In more recent times, the bank had set it eyes on subregional expansion. A high-powered delegation led by the Managing Director, Dr Walton Ekundayo Gilpin departed Sierra Leone for sister Republic of Liberia in November last year. Their mission; to research and evaluate opportunities for establishing a banking presence in Liberia.

The team analyzed market data, met with key Liberian officials (including the Governor of the Central Bank and Minister of Finance), and engaged potential partners. Part of RCBank’s long-term vision for regional expansion and to position Sierra Leone as a key financial player in ECOWAS.

That move signifies RCBank’s ambition to export its innovative banking services beyond Sierra Leone.It aligns with Sierra Leone’s national vision for local institutions to expand across West Africa. Ideally, a successful entry would boost RCBank’s assets and profits, and enhance Sierra Leone’s regional financial standing.