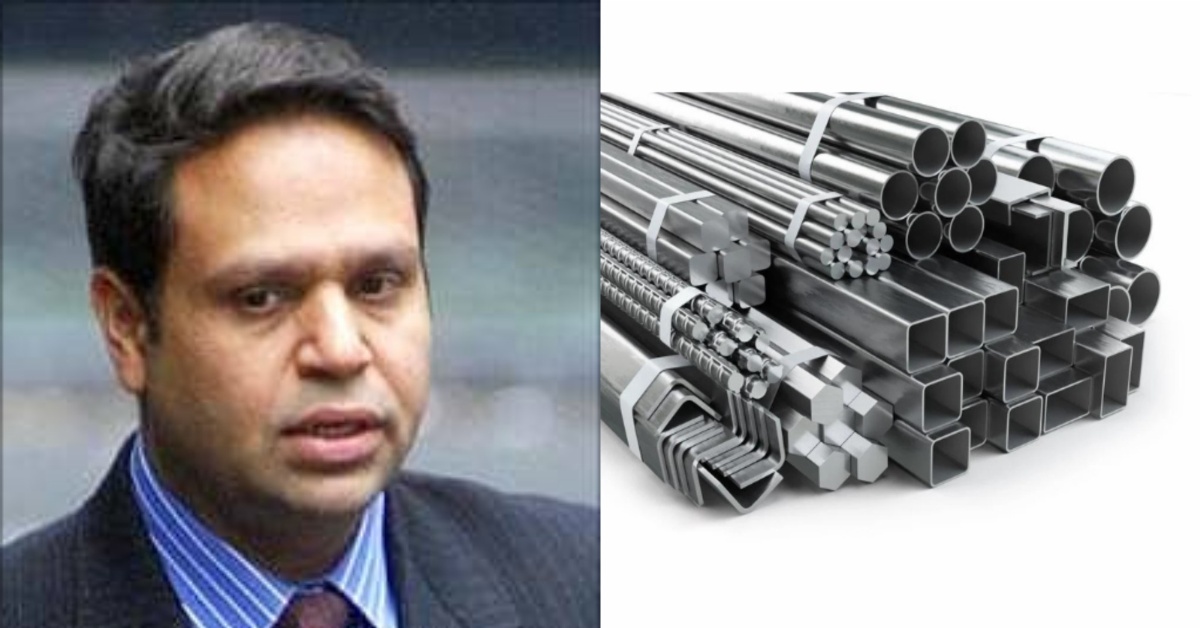

It has been revealed that a further £295,000 has been successfully recovered from Virendra Rastogi, also known as Vareen Kumar of Veerain Kumarr, a key figure convicted for his involvement in an intricate international metal trading scam, in a landmark development underscoring the unwavering commitment of the Serious Fraud Office (SFO) to combat financial crimes.

The recovered funds were sourced from two pension funds as part of an ongoing proceeds of crime investigation targeting Rastogi’s assets, marking a significant milestone in the relentless pursuit of justice and restitution.

Rastogi, formerly one of the directors of RBG Resources plc, found himself embroiled in legal proceedings initiated by the SEO in 2008 for orchestrating an elaborate metal trading scam that spanned the years 1996 to esulting in substantial financial losses for banks worldwide amounting to nearly $700 million.

Following a rigorous legal process, Rastogi, alongside his co-directors Anand Jain and Gautam Majumdar, was prosecuted and subsequently sentenced to nine and a half years in prison for his role in perpetrating the fraudulent scheme.

Central to the illegal activities orchestrated by Rastogi and his associates was the creation of over 300 fictitious customers purportedly linked to RBG Resources plc, with addresses spanning various global locations including Dubai, France, Hong Kong, India, Italy, Singapore, and the United States. These non-existent customers were instrumental in fabricating false metal trades, which were then exploited to secure illicit cash advances from unsuspecting financial institutions, thereby perpetuating the extensive fraud scheme.

The comprehensive investigation conducted by the SFO unveiled a web of deceit and deception woven by Rastogi and his collaborators, with startling revelations emerging regarding the purported customers and their fraudulent activities.

Instances were discovered where seemingly independent customers shared identical addresses, while one customer was traced back to a registered location that Turned out to be a cow shed in India, highlighting the extent of the subterfuge employed to deceive authorities and financial institutions alike.

Notably, the SFO’s relentless pursuit of justice extends beyond securing convictions, with a dedicated focus on

tracing, seizing, and recovering the ill-gotten gains amassed by individuals such as Rastogi to prevent them from benefiting from their criminal endeavors.

Through a meticulous and multifaceted asset recovery strategy, the SFO has thus far retrieved nearly £6 million in proceeds from Rastogi’s fraudulent activities, leveraging various channels such as the sale of his Marylebone residence and the seizure of valuable assets, including luxury watches, to fulfill its mandate of dismantling criminal networks and safeguarding the interests of victims.

Director of the Serious Fraud Office, Nick Ephgrave QPM, emphasized the agency’s unwavering commitment to pursuing justice and holding perpetrators of financial crimes accountable for their actions. In a statement affirming the SFO’s proactive approach to tackling criminal enterprises, Ephgrave stated, “Our work to bring justice doesn’t stop at conviction. We proactively seek out and pursue the proceeds of crime in whatever form they take, from pension pots to luxury watches, to ensure criminals like Rastogi don’t benefit from their crimes.”

As the SFO’s exhaustive proceeds of crime investigation continues to unfold, shedding light on the intricate networks underpinning international financial fraud, the recovery of £295,000 from Virendra Rastogi stands as a testament to the agency’s unwavering dedication to upholding the rule of law,

safeguarding financial integrity, and delivering justice for victims impacted by complex financial crimes of a global scale.