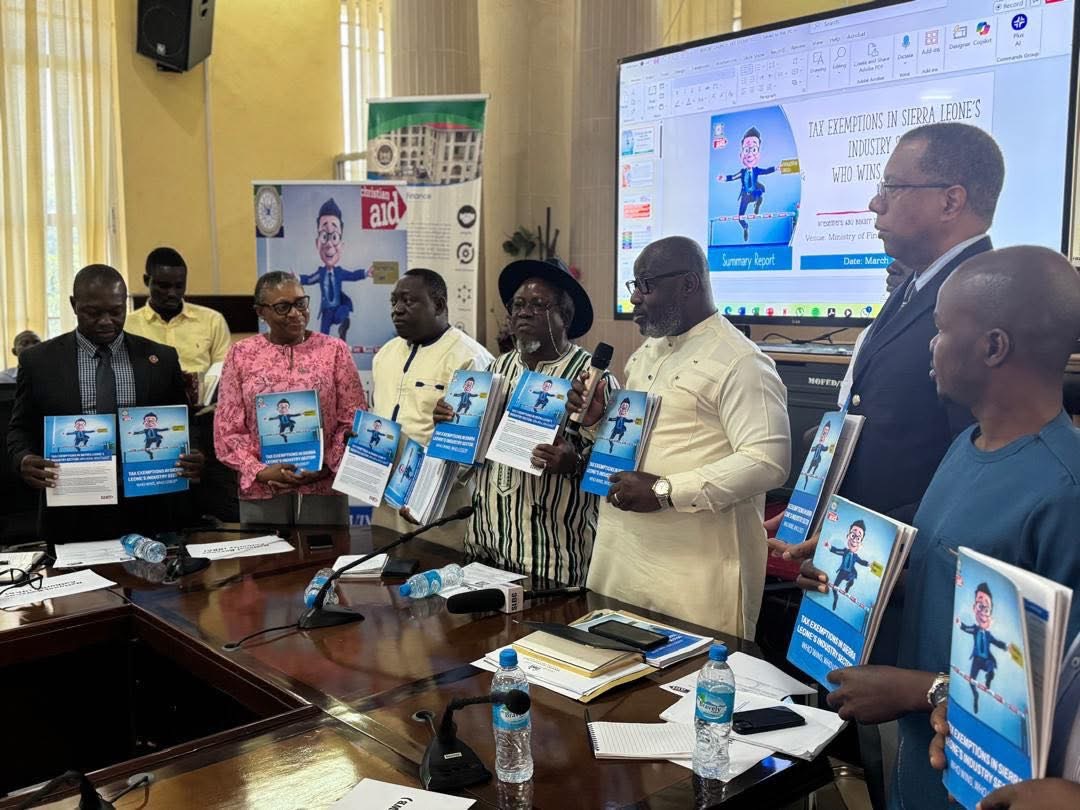

The National Revenue Authority (NRA), alongside the Budget Advocacy Network (BAN) and the Ministry of Finance, has launched an important report examining tax exemptions in the industrial sector of Sierra Leone.

The report, titled “Tax Exemptions in Sierra Leone’s Industry Sector: Who Wins, Who Loses?” was unveiled at a gathering of key stakeholders at the Ministry of Finance’s Main Conference Hall.

Key recommendations from the report include focusing tax incentives on sectors that have high growth potential for job creation and technology transfer, as well as improving transparency by publicly disclosing beneficiaries of tax exemptions. The report also suggests implementing performance-based incentives to ensure accountability.

NRA Commissioner-General, Mrs. Jeneba J. Bangura addressed the audience, emphasizing the complex role tax exemptions play in the economy. While those exemptions can entice foreign investment and drive industrial growth, the Commissioner expressed concern regarding their increasing fiscal burden.

Between 2018 and 2023, she revealed that tax exemptions in the industrial sector rose dramatically from NLe177 million to NLe3.5 billion, marking a nearly 20-fold increase. During the same timeframe, she added that the sector’s contribution to the nation’s GDP also saw significant growth, escalating from NLe 8.9 billion to NLe 35.6 billion, primarily benefiting the mining sector.

Mrs. Bangura pointed out a troubling statistic, admitting that the revenue lost from those tax exemptions now accounts for 60% of Sierra Leone’s domestic revenue, asserting that it raises pressing questions about the effectiveness and sustainability of the current tax incentive system.

In her remarks, Mrs. Bangura identified several challenges, including a lack of transparency and inefficiencies in policy implementation. She emphasized the NRA’s commitment to reforming the tax incentive framework in collaboration with the Ministry of Finance and stakeholders.

Mrs. Bangura reiterated the NRA’s commitment to refining tax policies that support sustainable development, aim to minimize revenue losses, and maximize economic benefits for the country.

She praised the efforts of BAN for their thorough report and called for a collaborative approach to implement the recommended changes, aiming for a fair and efficient tax system that aligns with Sierra Leone’s developmental goals.