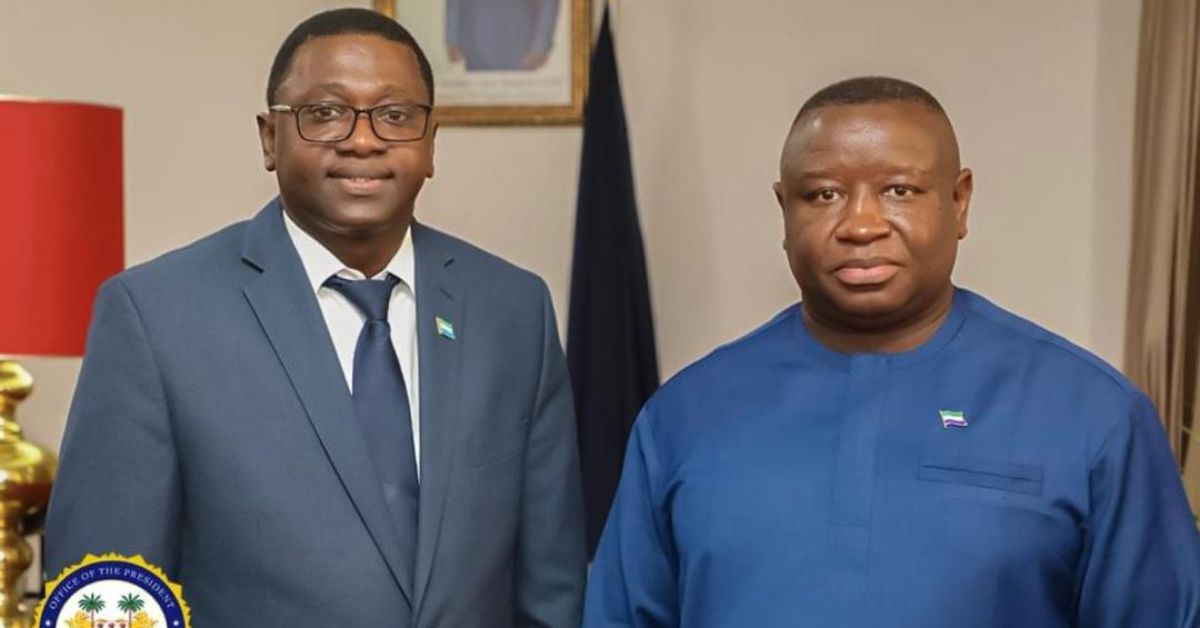

President Julius Maada Bio has officially signed the Finance Act 2024 into law following its passage by Members of Parliament in December 2023.

The Act includes a range of fiscal measures aimed at enhancing government revenue, according to a senior government official.

Key provisions of the Act include a 5% import duty tax on rice starting in 2024, which will increase to 10% in 2025. Additionally, a 20% tax on cement, a 5% tax on cooking gas, and a 10% tax on iron rods have been established. The Act also reduces the minimum Alternate Tax (MAT) rate from 3% to 2%, applicable only to loss-making companies.

The legislation further stipulates that income from digital products and services provided by companies like Google, Meta, and Amazon will now be taxable in Sierra Leone. Adjustments to withholding tax rates have been made, with dividends, management and professional fees, and lottery winnings now subject to a 15% rate.

Moreover, the government has introduced a 1% education levy and increased withholding tax rates for contractors, from 5.5% to 6.5% for residents and from 10.5% to 11.5% for non-residents. Excise duty rates have been harmonized between domestic and import sectors, excluding beer and stout, while excise duty on plastic products and a 10% tax on gambling, betting, and lottery have also been introduced.

The registration threshold for Goods and Services Tax (GST) has been raised from Le100 million to Le500 million. The government has reintroduced GST exemptions for plant and machinery in agriculture, manufacturing, mining, and petroleum sectors, as well as duty exemptions for certain manufacturing elements. Additionally, demurrage days have been adjusted from weekdays to official working days.

However, the introduction of the 5% tax on rice has sparked public outrage, with citizens expressing grave concerns over its impact on their daily lives. The price of a bag of rice has reportedly surged to between Le1,020,000 and Le1,250,000, depending on the type and quality. Many have pleaded with President Bio to reconsider the tax, citing the escalating cost of living as unbearable.

Mohamed Sawaneh, a teacher, voiced the frustrations of many citizens, stating, “Inasmuch as the government needs resources for development, they should consider the high cost of living and the challenges we face. Some of us find it extremely difficult to make ends meet, let alone cope with these harsh conditions.”

As the government seeks to balance revenue generation with public welfare, the implications of the Finance Act 2024 will continue to unfold amid increasing discontent among the populace.

SIGNING NEW FINANCE ACT WITH INCREASE IN TAXES ON BASIC LIVING ESSENTIAL COMMODITIES COMES WITH A LOT OF LIFE THREATENING CONSEQUENCES.

MANY SIERRA LEONEANS FIND IT ALMOST IMPOSSIBLE TO MAKE THEIR DAILY LIVING, WITH SALARY SCALE VERY LOW FOR THE AVERAGE CIVIL SERVANT.

INCREMENTS IN TAXES ON BASIC LIVING ESSENTIAL COMMODITIES IS AN ISSUE THAT EXPOSES MANY CITIZENS TO HUNGER, DISEASES, SUFFERING, AND UNFAIR TREATMENT TO VULNERABLE CITIZENS.

THE LAW MAKERS MUST KNOW THAT THEY ARE REPRESENTING THE PEOPLE AND THEIR DECISIONS MUST REFLECT THE WILL OF THE PEOPLE, IT’S THE CITIZENS THAT OWNS THE GOVERNMENT AND THEY ARE ACCOUNTABLE TO THOSE WHO ELECTED THEM(CITIZENS).

THE CITIZENS OF SIERRA LEONE WANTS DEVELOPMENT, BUT IT HAS TO COME WITH A LOT OF PUBLIC INTEREST IN MIND, SIERRA LEONE HAS TO GROW,YES WE ACKNOWLEDGE THAT BUT NOT AT THE EXPENSE OF HER CITIZENS.

I CAN’T IMAGINE HOW OUR INNOCENT CHILDREN, YOUTHS, AGED, PHYSICALLY CHALLENGED PERSONS, UNEMPLOYED AND EVEN THOSE WITH SALARY SCALE VERY LOW WILL SURVIVE WITH A BAG OF RICE COSTING BETWEEN NLe 1,020 to NLe 1, 250.

LET’S SIERRA LEONEANS BE TREATED WITH RESPECT AND LOVE THROUGH THE POLICIES AND LAWS OUR LEADERS MAKE.

Hmm! Our government well done.

Who are you developing for, the dead?

Do you really have people at heart? No! All these are to enrich yourself. God will surely punish you people.

This is the worst government I have ever seen in my lifetime. But God will judge all of those that has brought us to our knees suffering for basic living condition.

Where are we heading to ,is this what we voted for or other wise.

Anybody that survives in Sierra Leone under the Bio led govt. is a super man. My Brother’s sang really well. Prezzo Bio, you promised us a better living hood under your administration. You campaign about high cost of living, high transportation, high corruption and so on, but what have you done so far to combat those existing challenges? Nothing at all. To the law makers, why have you failed to consider the suffering masses? Why have you forgot so soon your promises to represent the will of your people? In all the tax increment over the years what impact has it made on the lives of ordinary people? Where’s the development we can point that have impacted our lives. We’re disappointed, and we pray for God’s judgement on you all the occupied the corridors of power