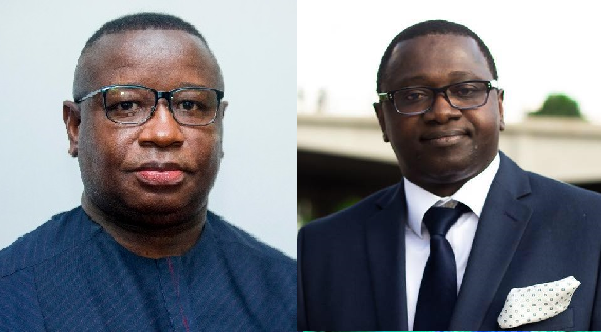

Sierra Leone’s Minister of Finance Sheku Ahmed Fantamadi Bangura has held a series of direct engagements with the National Revenue Authority (NRA) in response to significantly lower-than-expected domestic revenue generation for January and February 2025

The meeting, held at the Customs Department, focused on the country’s poor revenue performance, with President Dr. Julius Maada Bio showing his disappointment over the decline.

“President Bio is frustrated with the low revenue figures, especially with a revenue-to-GDP ratio of just 8.1%,” said Minister Bangura. “We need to take immediate action to boost revenue, especially as government spending continues to rise.”

Bangura stressed the importance of following tax laws and reforms. He also pointed out the government’s investment in new technologies aimed at improving tax collection.

Matthew Dingie, the Financial Secretary, said that everyone has a role in increasing revenue: “It’s not just up to one department; we all need to contribute.”

NRA Board Chair Kabineh Kallon emphasized that revenue targets are minimum benchmarks, not maximums, and implored staff to adhere to legal procedures for tax collection. Deputy Minister of Finance II, Bockarie Kalokoh, identified specific areas requiring improvement, including Goods and Services Tax (GST), Pay As You Earn (PAYE), and Customs.

Commissioner General of the NRA, Jeneba Bangura, revealed a 25% revenue shortfall since January 2025, stressing the imperative to reverse this trend. She welcomed the Ministry’s intervention, stating it reinforced the President’s position on the matter.

The Ministry’s team conducted visits to the Customs Department at the port, the ITS scanning facility, and the Domestic Tax Department, addressing issues related to compliance, enforcement, technology utilization, and staff conduct.

Dr Samuel Jibao was doing extremely well in at NRA.president should reinstate him

It is simple Maada Bio. You and the rest of the cocaine traffickers destroying our country, slowed down your importation of cocaine recently because of all the negative publicity, so customs revenue from container charges us down. Don’t worry, by March, April, you will be back to selling all the cocaine you used to and NRA revenue will be back

They started their dubious game again