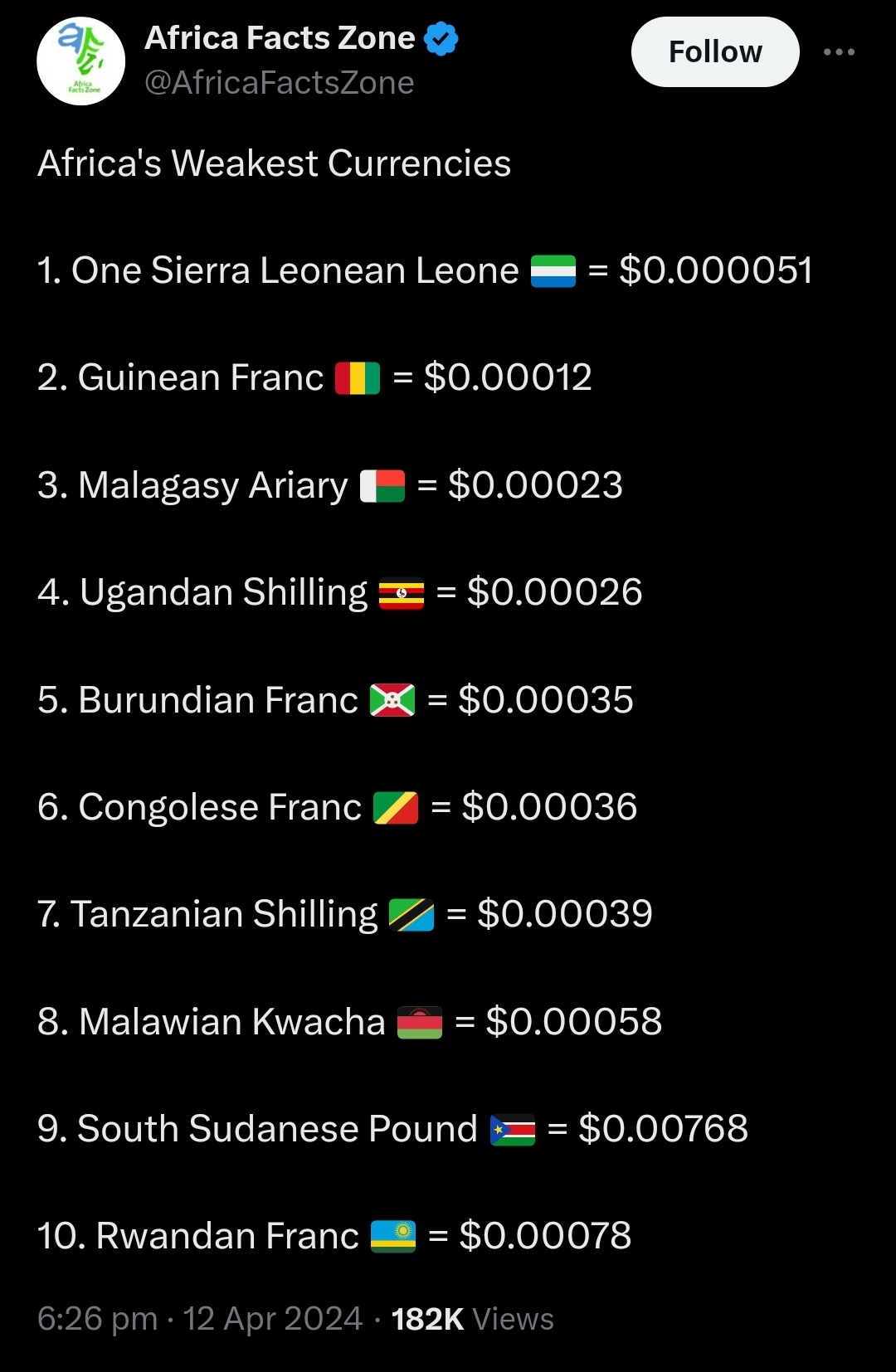

In a recent report published by a prominent web portal specializing in currency analysis, Africa Facts Zone has identified the continent’s weakest legal tenders for the year 2024.

Topping the list is Sierra Leone’s Leone, signifying a poignant narrative of economic struggle and historical turmoil.

Presently, the exchange rate stands at 1 SLE to USD 0.000051, highlighting the Leone’s precarious position in the global financial landscape.

The Leone’s designation as Africa’s weakest currency underscores the enduring legacy of civil strife, political instability, and fiscal mismanagement plaguing many nations across the continent. Despite efforts to revive its economy, Sierra Leone continues to grapple with the ramifications of its troubled past, hindering prospects for sustained growth and stability.

Among West African currencies, the Leone stands out with the lowest valuation, reflecting its vulnerability to factors such as high inflation, economic fragility, and mounting debt burdens.

The currency underwent a significant transformation on July 1, 2022, with a redenomination that saw the old Leone (SLL) replaced by the new Leone (SLE) at an exchange rate of 1,000 SLL to 1 SLE.

The report further highlights other African currencies grappling with similar challenges, including the Guinean Franc, Malagasy Ariary, Ugandan Shilling, and Burundian Franc, among others. These currencies reflect a broader pattern of economic vulnerability stemming from a combination of internal strife and external pressures.

Despite the formidable obstacles facing these nations, there remains hope for economic revitalization through strategic reforms, international cooperation, and sustainable development initiatives. As Africa navigates its path towards prosperity, addressing the underlying issues plaguing its currencies will be paramount in fostering inclusive growth and stability across the continent.

🥵🥵🥵

We always top in terms of negative i

ssues

Sierra leone where are we heading to?

From bad to worst

May All

Ooo sierra Leone 🇸🇱 God 🙏 help ours poor 😭😭😭😭😭😭