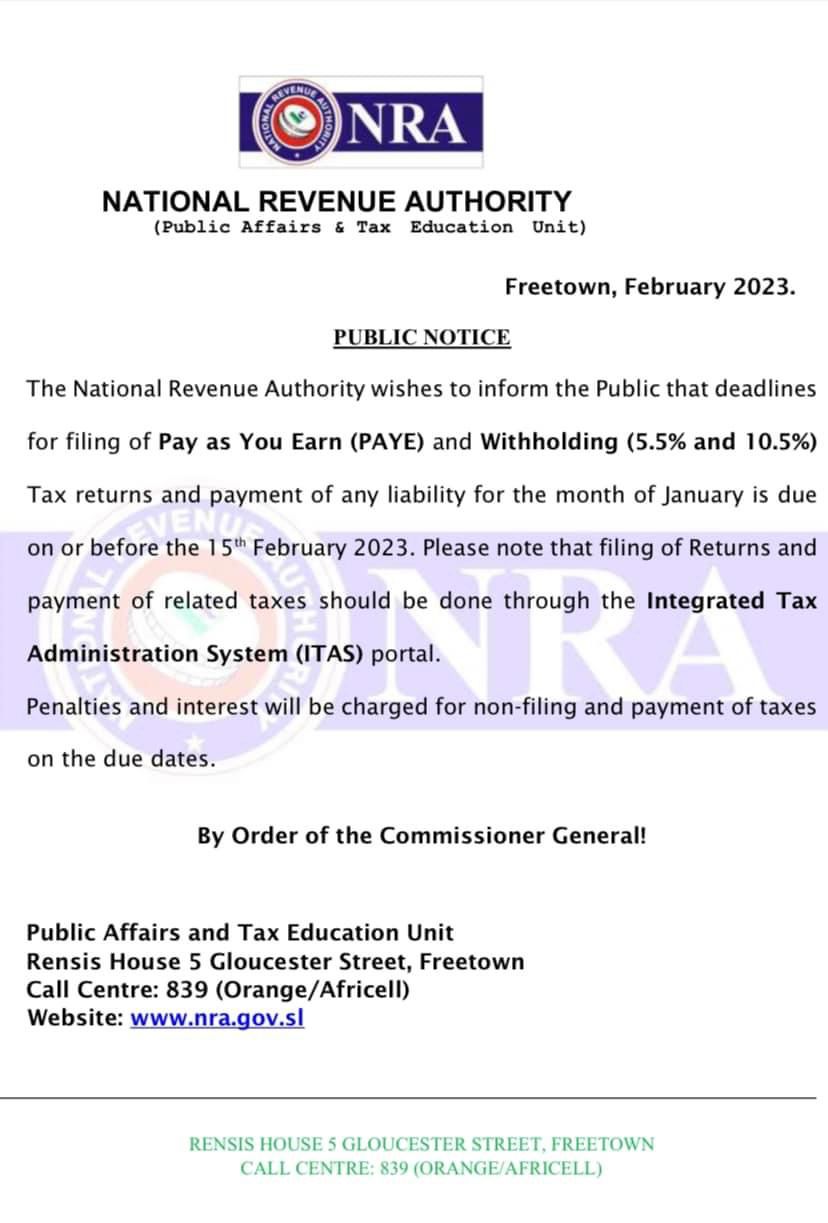

The Public Affairs and Tax Education Unit in the National Revenue Authority (NRA) has announced that the deadline for tax returns and payment of any liability for January are due on or before 15 February 2023.

NRA made this announcement in a public notice ordered by the Commissioner General, informing the general public about the deadline set for tax returns and payment of any liability for January 2022.

The notice stated that deadlines for tax returns and payment of any liability for January are due on or before the 15th of February 2023, and should be done through the Integrated Tax Administration System (ITAS) portal.

The notice continued that penalties and interest will be levied against defaults.

The National Revenue Authority (NRA) was established in September 2002 through an Act of Parliament called the National Revenue Authority Act is charged with the responsibility of assessing and collecting domestic taxes, customs duties, and other revenues specified by law, as well as administering and enforcing laws relating to these revenues.

The department is geared to support government reforms in improving doing business experience in Sierra Leone. The Department maintains an integral role in facilitating the free movement of persons and goods across the country’s frontiers, with emphasis on turnaround time and client experiences, and border controls.