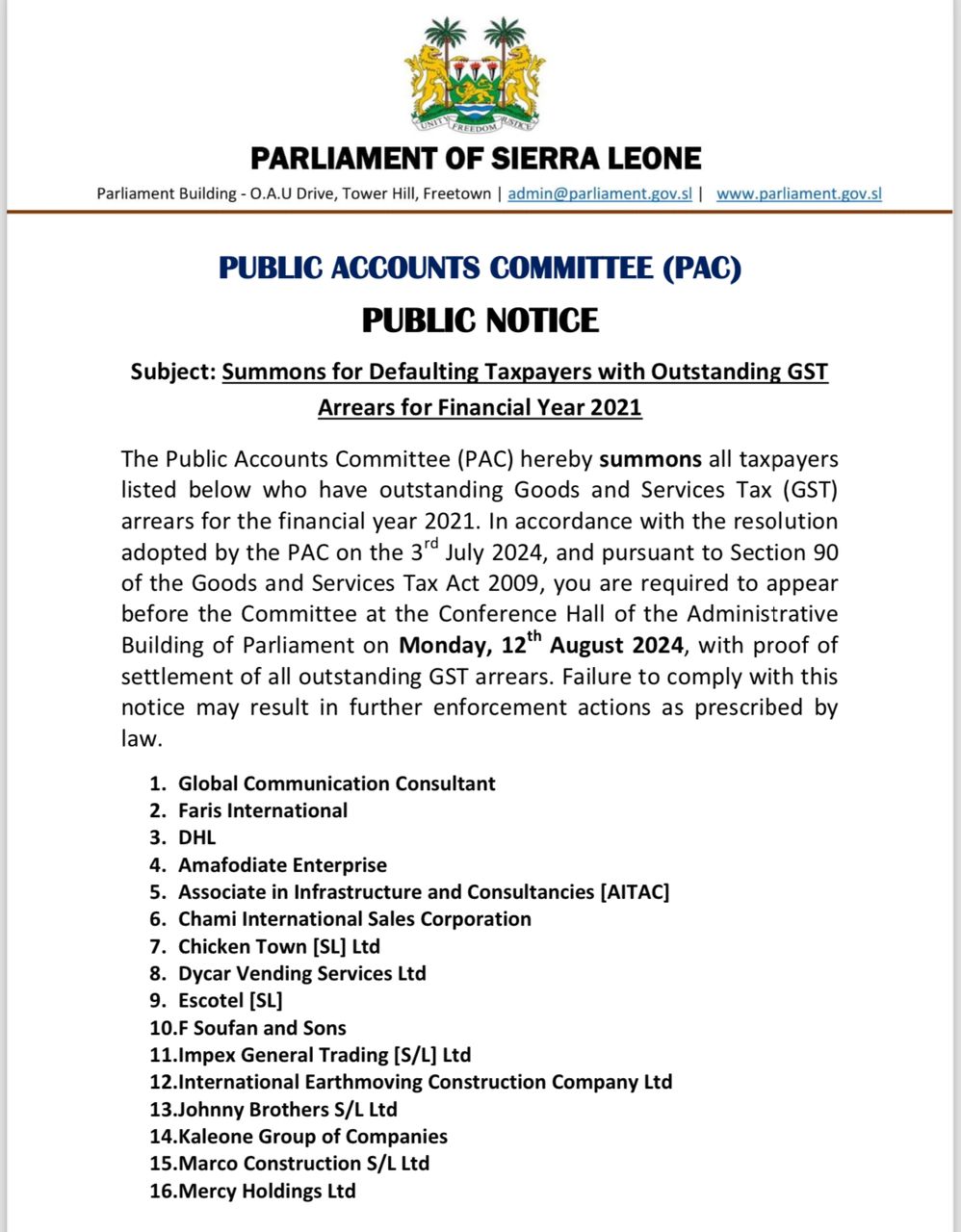

The Public Accounts Committee (PAC) has issued a summons to taxpayers with outstanding Goods and Services Tax (GST) arrears for the financial year 2021. This action follows a resolution passed by the PAC on July 3, 2024, and is in accordance with Section 90 of the Goods and Services Tax Act 2009.

The PAC has called on the following entities and individuals to appear before them at the Conference Hall of the Administrative Building of Parliament on Monday, August 12, 2024, with proof of settlement for their GST arrears:

1.Global Communication Consultant

2.Faris International

3.DHL

4.Amafodiate Enterprise

5.Associate in Infrastructure and Consultancies (AITAC)

6.Chami International Sales Corporation

7.Chicken Town [SL] Ltd

8.Dycar Vending Services Ltd

9.Escotel [SL]

10.F Soufan and Sons

11.Impex General Trading [S/L] Ltd

12.International Earthmoving Construction Company Ltd

13.Johnny Brothers S/L Ltd

14.Kaleone Group of Companies

15.Marco Construction S/L Ltd

16.Mercy Holdings Ltd

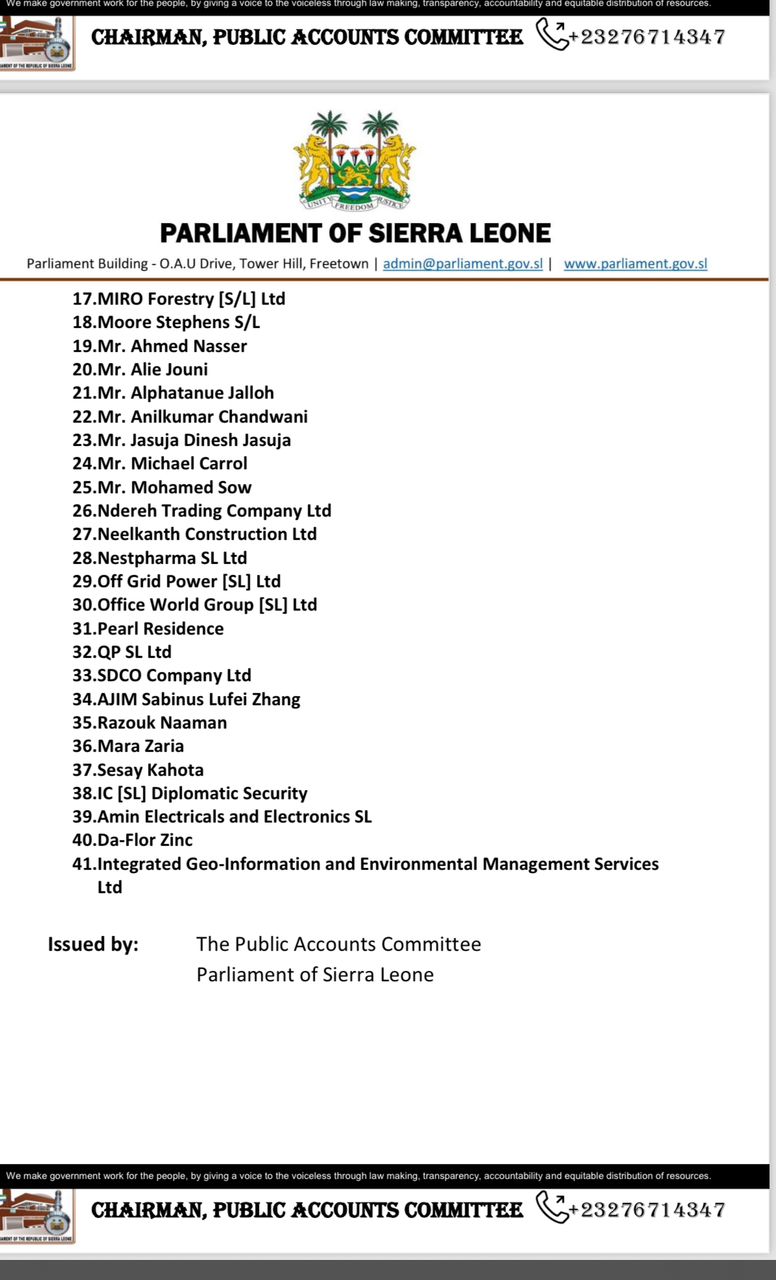

17.MIRO Forestry [S/L] Ltd

18.Moore Stephens S/L

19.Mr. Ahmed Nasser

20.Mr. Alie Jouni

21.Mr. Alphatanue Jalloh

22.Mr. Anilkumar Chandwani

23.Mr. Jasuja Dinesh Jasuja

- Mr. Michael Carrol

-

Mr. Mohamed Sow

-

Ndereh Trading Company Ltd

-

Neelkanth Construction Ltd

-

Nestpharma SL Ltd

-

Off Grid Power [SL] Ltd

-

Office World Group [SL] Ltd

-

Pearl Residence

-

QP SL Ltd

-

SDCO Company Ltd

-

AJIM Sabinus Lufei Zhang

-

Razouk Naaman

-

Mara Zaria

-

Sesay Kahota

-

IC [SL] Diplomatic Security

-

Amin Electricals and Electronics SL

-

Da-Flor Zinc

-

Integrated Geo-Information and Environmental Management Services Ltd

The PAC has warned that non-compliance with this notice may lead to further enforcement actions as prescribed by law. The hearing aims to resolve outstanding tax obligations and ensure adherence to tax regulations.

Post a comment

Post a comment