The Bank of Sierra Leone has issued a Frequently asked questions and Answers notice to the public as a means of Public education about the Leones.

The frequently asked questions and answers publication is geared towards answering sensitive questions within the Sierra Leone Public about the introduction of the new Leones.

Why is there a need for redenomination?

The current note regime places a significant burden on the economy in terms of: Transaction costs, General inconvenience and high risks of carrying large volume of notes to undertake transactions, high risks of carrying large volumes of cash, difficulties in maintaining bookkeeping and statistical records, problems with accounting and data processing software, and strain on the payment system – ATM withdrawal.

Will I lose value if I exchange my old notes and coins for new notes and coins?

No. The new notes and coins will have the same value as the old notes and coins. E.g. the cost of litre of petrol current at Le12,000 will cost Le12 in the new currency.

10 litres of petrol= Le 120,000(old note)

10 litres of petrol=Le120 (new note)

A loaf of bread=Le2,000(old note)

A loaf of bread=Le2 (new note)

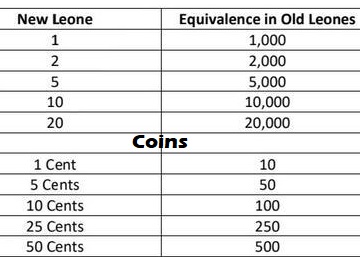

What is the relationship between the old and new Leone Currency?

Does it mean that the Leone is going to be devalued or revalued?

No. The old and new notes and coins will have the same external value. For example, if the day’s exchange rate between the Leones and the US dollar is US$1=Le 10,800, then the exchange rate of the new currency will be; US$1= Le10 and 8 cents

What happens to the old notes and coins when the new notes and coins are introduced?

The old notes and coins will be in physical circulation together with the new notes and coins. Prices and fees will have to be quoted in both the old and new notes and coins for the transition period.

What happens after the transition period?

You will still be able to exchange the old notes and coins for new notes and coins at any bank or the Bank of Sierra Leone. After a period of time, the old notes and coins will cease to be legal tender and will no longer be in use

What will be the level of involvement of other agencies/organizations in the implementation of the policies?

The cooperation of every citizen is vital.

More specifically, the Governor’s Advisory Committee has been setup. This Committee comprise of a broad range of stakeholders. The goal is to ensure that there will be no unintended effects, minimize the adjustment costs (if any) of the exercise and to engender national ownership of the process.

Will this affect my wages and salaries?

NO. Your wages and salaries will now be denominated in the new currency but its value will remain the same. For example, if you are now earning Le600,000 a month and you spend Le400,000 on your household needs, and save Le200,000, it mean that you will now earn Le600, spend Le400 on your household needs and save Le200. Thus, your situation remains the same

What will happen if I receive a remittance from abroad? If US$100 remittance from abroad gives you Will this exercise lead to price increases?

No. The basket of goods and services that the old notes and coins can buy would be the same as what its equivalent new notes and coins will buy. For comparison, prices will be quoted in both new and old notes and coins at the same time during the transition period.

What’s the main benefit of Redenomination?

Redenomination reduces the burden of carrying large bags of money around (we could say it reduces transaction costs).

Does redenomination have any real Economic effects, i.e. Can redenomination help Sierra Leone’s GDP to grow?

No. Redenomination doesn’t affect aggregate supply or aggregate demand of an Economy. Any growth in the economy is as a result of an increase in demand or supply. For instance, if corporate tax-rates are set right, that stimulates innovation and consequently boost production or supply. If consumption taxes (i.e. VAT) are set right, people would buy more and demand would increase (I will add to this in subsequent answers).If still not convinced that Redenomination has no positive ECONOMIC effects, think a second about this: “If redenomination had any positive economic benefits, wouldn’t we see countries re-calibrating their currencies rampantly just to increase the national pie?”

What is (are) the expected impact of redenomination then?

It could lead to: better anchoring of inflation expectations; enhanced public confidence in the Leone; easier conversion to other major currencies, reversed tendency for currency substitution; reduced cost of production, distribution and processing of currency; more usage of coins and thus a more efficient pricing and payments system; availability of cleaner notes; deeper Forex market; more effective liquidity management and efficient monetary policy.

Why doesn’t redenomination affect the production activities (aggregate supply) of an economy?

A country’s ability to produce is determined by 3 main factors: Resources, Technology and Institutions. It’s very easy why technology is a determinant of production. Institution includes political stability, and the provision of the right incentives to produce. For instance, tax-rates must not be too high to inhibit innovation and should not be too low to prevent government activity (like welfare programs, construction of roads, etc.

Really, Redenomination doesn’t make the Sierra Leone currency stronger?

No. The strength of a currency is determined by the market factors, ie demand and supply for the currency. Since the purchasing power of the currency remains unchanged after redenomination, we should not expect demand for Leone to change. Similarly, redenomination doesn’t give the monetary authorities any justification to change the supply of money.

What is the optimal number of zeros to chop off?

From an economic point of view, this is a normative question and hence would differ from individual to individual. Personally, I think it doesn’t matter. I expect people to adapt rapidly and expect no significant mistakes in their nominal calculations. People are really careful with money and this trait would reduce the incidence of mistakes. (I still find it a mystery that my grandma, who has never been to school, is able to quote the total price of 16 and 3/4 crates of Coca-Cola). However, chopping off 4 zeros could be motivated by accounting convenience

So, if redenomination reduces transaction costs, would it increase the rate of transaction and hence increase GDP?

Possibly, but in no significant way. I don’t think the burden of carrying large bags of money prevented people from partaking in transactions. There were fortunately other ways to carry money (wiring through banks, travellers cheques, etc.). Hey, in the olden days, when people used gold for trade and there existed no wire transfer mechanisms, the market survived despite the ridiculous weights of gold, right?

When will the redenomination take effect?

Tentatively, there will be a ‘transition period’ during which both the ‘old Leone’ and ‘new Leone’ will be legal tender. During the period, prices, salaries, etc can be quoted in both the new and the old Leones. Thus, the current Leones will still be legal tender on the commencement date, After the end of the transition period, the ‘old Leones’ will cease to be legal tender, but can still be exchanged at the Bank of Sierra Leone

Which other countries have successfully undertaken such reforms?

Ghana (2007), Poland (1995), Croatia (1994), Uganda (1987), Zambia (2012) and several others including Israel, Turkey, Germany, South Korea, China, Brazil, etc.

Sierra Leone is not imitating any country.

We are redenominating because the fundamentals of our currency structure require the new direction. We would also implement it in a way that takes our peculiarities into account.

We have learnt from the experiences of those who did it before us and would strive to make ours the most successful (just as we did with the resizing of the Leone in 2011).

Will currency redenomination not entail enormous costs?

No. The new policy will not translate to high costs. Indeed, it will lead to much lower costs of printing, processing and management of currency over time. The following points are illustrative:

• Most countries typically stock-pile 2-3 years of buffer stock of currency and when they embark upon currency redesign or redenomination, such buffer stock is lost. In our case, we have no buffer stock. The ‘old Leone’ notes to be used in 2022 are just the ones currently under printing/minting. The life span of these notes is short, and there will be no waste. No new order will be placed for printing the ‘old Leones’in 2022.

• Even without redenomination, BSL would typically still incur costs in printing/minting the currency.

• Because the new currency structure will be dominated by coins (which last an average of 10 – 20 years) compared with currency notes which last a few months, the total cost of currency issuance and management will drastically be reduced over time.

Will the new Leone Policy or the redenomination solve all of Sierra Leone’s economic problems?

No. The redenomination is not an end in itself. It will however complement the government macroeconomic reforms in trying to improve the country’s socioeconomic environment.

Will the redenomination policy undermine the proposed ECOWAS common currency?

No. It is consistent with the proposed ECOWAS common currency and Sierra Leone is committed to the subregional goals. Ghana redenominated (by dropping four zeroes) in 2007 and it is also part of the common currency agenda. Our policy agenda will provide leadership in the process of monetary integration.

How will the Leones be redenominated?

By dropping three zeros from the currency or moving three decimal places to the left. The name of the national currency will still be the Leones. However, during the transition period, the existing Leone will be referred to as the “Old Leone”, and the new one will be called the “New Leone”. After the transition period, the word “New” may be dropped

Does the Bank of Sierra Leone have adequate plans to sensitise/educate Citizens, especially in the villages/rural areas about the change?

Yes. This is why we have announced the policy early. Specifically: We have started stakeholder engagements and we are currently designing a mass education/sensitisation programme. The programme will be translated into several local languages.

We plan to collaborate with mass organizations including labour unions, religious organizations, NGOs and Civil Society organizations, schools/Universities, professional organizations and trade unions, market associations, transport unions, organized mass mobilization agencies such as the National Orientation

Agency, state and local governments, military/paramilitary organizations, council of traditional rulers, the mass media, etc to reach and educate every Sierra Leonean on the change.

We shall embark on two phases of enlightenment programme: first a general nation-wide enlightenment on what the policy is all about; second nation-wide education on the operations of the programme, especially pricing/conversion from old to the new.

How will the redenomination work?

• The ‘new Leone’ will be different from the existing ones i.e. in design, appearance, security features, etc.

• All Leone assets and liabilities (including bank deposits), prices, fees, rents, and contracts (including salaries and wages) will be redenominated by dropping three zeroes or moving three decimal points to the left.

• During the ‘transition period’ prices will be quoted in both the ‘new Leone’ and the ‘Old Leone’ and everyone will have the choice of paying in the new or old Leone.

• There will be a period were everyone get familiar with the conversion, and it will become self-evident to everyone why he/she would prefer to transact in the ‘new Leone’ rather than the ‘old Leone’. For example, if a bag of rice sells for Le300,000 (old Leone), the price in ‘new Leone’ will automatically be Le300. The customer will choose to pay either Le300,000 in old

Leone or Le300 in the ‘new Leone’. In the supermarkets and formal market prices will be displayed in both currencies till the end of the transition period.

Is it true that currency redenomination is usually done under conditions of hyperinflation?

Not necessarily. Indeed, countries that did it under such circumstances without complementary reforms ended up re-doing it again and again.

Redenomination is most successful when a country has achieved a measure of price stability and restored confidence in the national currency. It then proceeds to remove the ‘zeroes of shame’ to get the currency properly aligned. This is the condition now in Sierra Leone

Is the redenomination policy a re-valuation or resort to a fixed exchange rate regime?

No. Redenomination is not the same as revaluation. A revaluation entails an official adjustment of the exchange value of a country’s currency (usually an upward change in value) relative to other currencies by fiat under a fixed exchange rate regime. BSL will continue to maintain a market determined exchange rate regime