The Central Bank of Sierra Leone has reported a remarkable decrease in the country’s inflation rate, a development that signals improved economic stability.

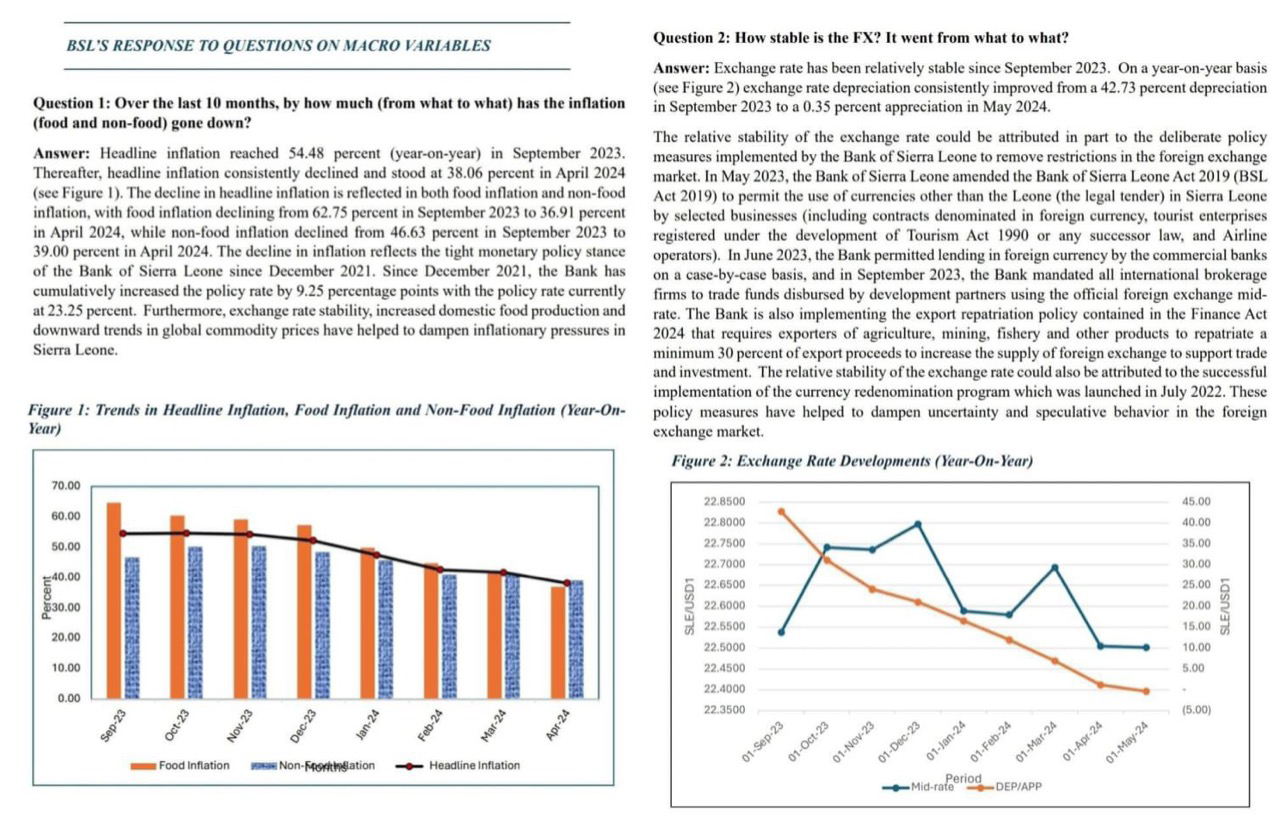

The latest data reveal that headline inflation has dropped from a staggering 54.48% in September 2023 to 38.06% in April 2024. This decline marks a 16.42 percentage point reduction over a span of just ten months.

The decrease in inflation is evident across both food and non-food sectors. Food inflation, which previously stood at an alarming 62.75% in September 2023, has seen a significant reduction to 36.91% by April 2024. Non-food inflation has also trended downward, moving from 46.63% to 39.00% over the same period.

The Central Bank attributes this decline to several key factors. Primarily, the tight monetary policy stance adopted since December 2021 has been instrumental. The Bank has cumulatively increased the policy rate by 9.25 percentage points, with the current rate standing at 23.25%. This policy tightening has helped to curb inflationary pressures by controlling the money supply.

Additionally, exchange rate stability has played a critical role in this downward trend. By managing the value of the national currency more effectively, the Bank has been able to reduce the volatility that often contributes to inflation spikes. Increased domestic food production has also alleviated some of the inflationary pressures, as the availability of locally produced food reduces reliance on imports, which can be subject to fluctuating global prices.

Global commodity prices have shown a downward trend, further easing inflationary pressures. This global context, combined with the Central Bank’s proactive measures, has created a more favorable environment for economic stability.

Are we living in the same country with the Central Bank Statisticians? Which food items apart from seasonal foods that have decreased? The prices have largely remained static with a few increases there and there. For example, EDSA top-up has increased surreptitiously. So where has the decreased been recorded as I’m confused by this report

It is a saggering lie, as indicators show more pressure on the people of Sierra Leone.

To you SierraLòaded somethings tem wuna nor post them as they are lies