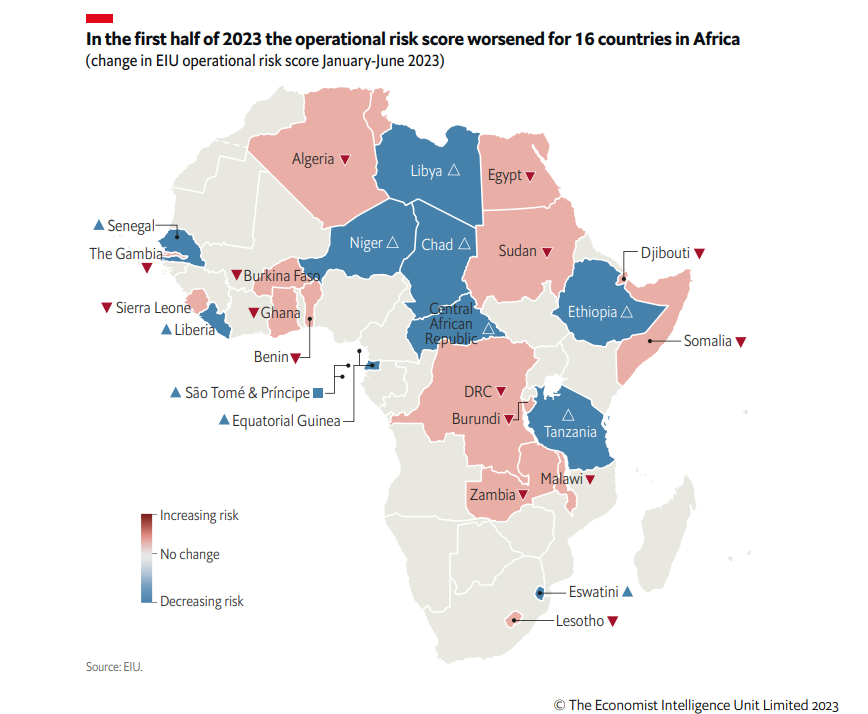

Sierra Leone is among 16 of 51 African nations that experienced a decline in operational risk between the close of 2022 and mid-2023, as reported by the Economist Intelligence Unit’s (EIU) most recent Operational Risk Outlook.

Other countries with an increasing risk outlook include Ghana, Algeria, Benin, Somalia, Burkina Faso, Zambia, DRC, Burundi, Malawi, Egypt, Lesotho and Sudan.

The UK-based agency cites a significant downturn in the macroeconomic risk subcategory as the primary reason for this decline.

During the period between late 2022 and the middle of 2023, the operational risk scores deteriorated for 16 out of the 51 African nations covered by EIU’s Operational Risk Service. This decline can be attributed to the adverse effects of escalating domestic consumer prices on business profitability, further influencing exchange-rate and monetary policy.

The EIU said widespread corruption in public services, bureaucratic red tape, a lack of accountability among civil servants, limited government control beyond key urban capital centres, a lack of judicial independence, excessive state authority, infrastructural deficiencies, shallow financial markets and a lack of skilled labour will continue to hold back Africa’s operational risk environment in the medium term.

However, the EIU emphasized that even with challenges like the Russia-Ukraine conflict and the lingering impact of the COVID-19 pandemic from 2020 to 2021, the macroeconomic risk remains the top-rated subcategory in the region. This subcategory holds an average score of 43, equivalent to a ‘C’ rating, a testament to the rapid economic growth associated with growing populations.

In contrast, 11 out of the 51 African countries witnessed an enhancement in their risk outlook. This group includes Tanzania, the Central African Republic (CAR), and Ethiopia. The positive shifts are tied to specific country circumstances, such as Ethiopia’s relative stabilization following two years of civil unrest and the initiation of its peace agreement, and the CAR finalizing a deal with the International Monetary Fund in April 2023.

The EIU further commented, “Given the escalating public debt and the region’s relatively low banking supervision and autonomy, we anticipate a significant risk of turmoil within the financial sector.”

This is getting worse Sierra Leone where are we heading to