It makes no sense that the current governor who heads the prudential regulator and single-handedly carried out the senseless redenomination and has no clue and right to put his views direct to the consumers, whether or not the governor agrees.

This is not stable or sensible and on the basis of my experience; its downright dangerous.

I was made to understand that the PAOPA regime is equipped with prudent financial analyst who must have gotten wider understanding on drawing up budgets, unfortunately, the repeated mishaps and recklessness showcasing at all ministries, departments, agencies and even parastatals is absolutely nothing good to write off.

I will be narrowing it down and make it snappy in exposing Bio’s shortfalls and porous policies in managing fiscal issues.

However, the modulated cadences of budgeting small adjustments made according to fixed procedures and schedules should not be allowed to block forthright action.

When crisis strikes, political leaders feel impelled to act, even if doing so temporarily bypasses or disables the budget process.

But actions taken in response to extraordinary challenges can have lingering impacts on administrative practices as well as on the government’s fiscal position long after the special circumstances have passed; President Bio repeated misuse of state resources in the form of travelling perdiem and blatant looting from our consolidated funds has drastically increased our deficit balance at the central bank of Sierra Leone.

Furthermore, obfuscation in the bill around how “ad hoc committees” will function in a crisis adds to the sense that much of the new wiring between the bank and the Treasury has not been properly thought through. These need to be fixed and our amendments set out to do that.

Wisdom and experience are vital for good leadership qualities that in my view could be found equally well in an external as an internal perspective.

But the bank needs more than the right personality. If the governor is to have a fair chance of success, the flaws in objectives, accountability and crisis management must be resolved immediately.

We are currently experiencing one of the deepest and most complex crises witnessed by Sierra Leoneans in many decades.

At the root of the crisis, we find the combined effect of a number of market failures as well as regulatory failures that explain how the turmoil stemming from a relatively small segment of the S/Leone mortgage market has translated into a national crisis posing a number of challenges for our economies and societies.

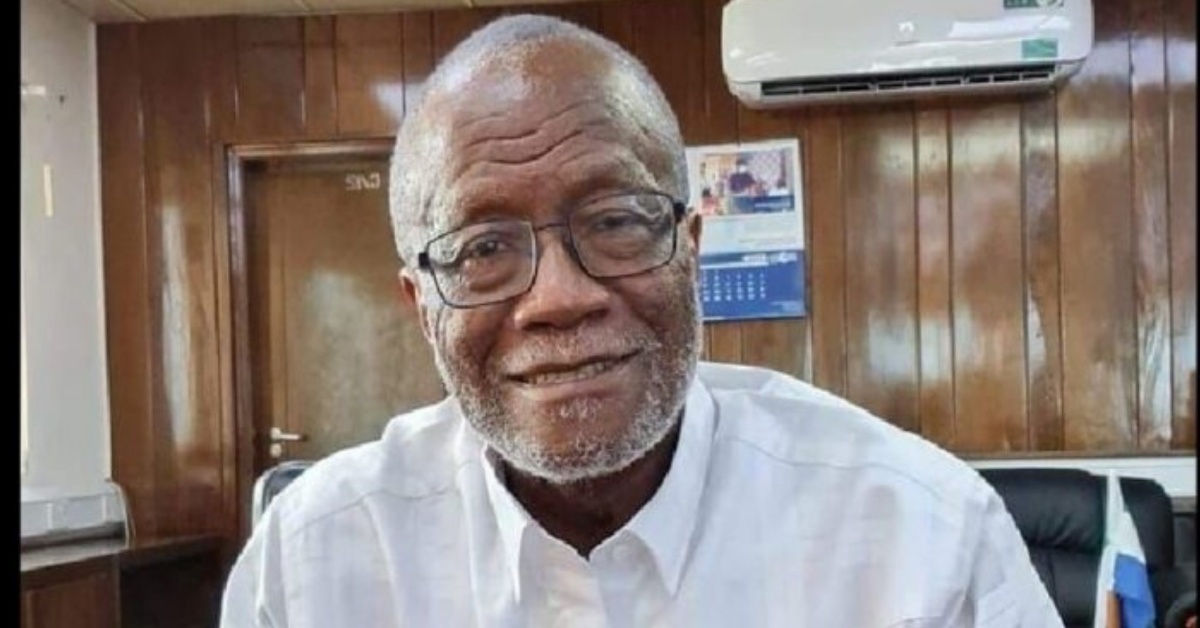

The notions of market and regulatory failures are at the heart of the Public Economics field as eminent in the porous policies regulated by the current BANK GOVERNOR whose financial policies aren’t translating to the evolving financial challenges.

It goes without saying that, determining the appropriate policy responses to the crisis requires a thorough understanding of its underlying causes. For this purpose, it is important to distinguish the macroeconomic factors from those of a microeconomic nature.

The 2023 general elections will define the prevailing riff poverty tearing our nation apart due to the Bio led administration failure to protect and delivering on the much talked NEW DIRECTION MANIFESTO compounded with ineptness and rampant corruption right across this misdirection regime.

Post a comment

Post a comment

Comment(s)

Disclaimer: Comments expressed here do not reflect the opinions of Sierraloaded or any employee thereof.

Be the first to comment