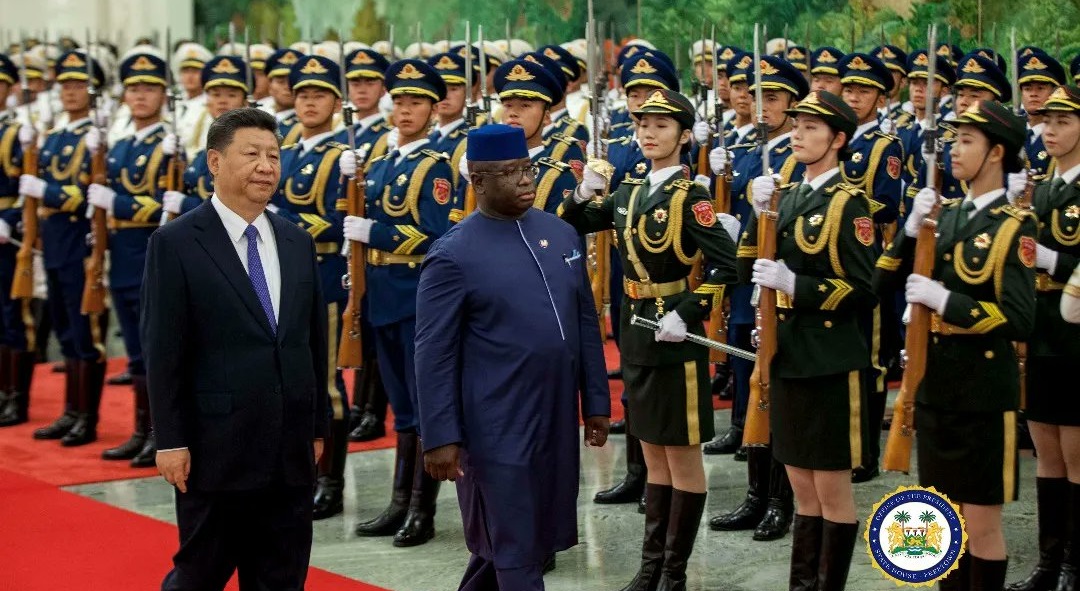

As President Julius Maada Bio of Sierra Leone prepares for the Africa China Summit and a state visit to China, to strengthen bilateral relations and secure investments, government must pause and reflect on the perilous path the nation is treading. While the allure of foreign investment and infrastructure development is undeniable, the recent trend of cozying up to Chinese lenders in exchange for long-term concessions poses significant risks to the sovereignty and economic stability of Sierra Leone.

The agreements signed by the Sierra Leonean government with Chinese companies, granting them lucrative contracts in vital sectors like mining, marine, and infrastructure, raise serious concerns about transparency, accountability, and the long-term interests of the Sierra Leonean people.

The toll gate contract with China Railway Sixth Group (CRSG) and the Pepel rail agreement with China Kingho, now Leone Rock Mining Group, are just a few examples where Chinese interests seem to have been prioritized over the welfare of Sierra Leonean citizens.

The experiences of other countries serve as cautionary tales that Sierra Leone cannot afford to ignore. Across the globe, a dozen nations find themselves ensnared in a web of Chinese debt, struggling to repay loans that have been shrouded in secrecy and unfavorable terms. From Zambia to Sri Lanka, the consequences of entering into these agreements without careful consideration are dire. Defaulting on Chinese loans has led to economic instability, political upheaval, and a loss of sovereignty for these nations.

In Zambia, once hailed as an economic success story, Chinese loans for infrastructure projects have left the country drowning in debt, with soaring inflation, high unemployment, and widespread poverty becoming the new normal. Sri Lanka’s decision to hand over control of its strategic port to Chinese companies after defaulting on loans serves as a stark reminder of the harsh realities of debt-trap diplomacy.

Sierra Leone cannot afford to fall into the same trap. The lack of transparency surrounding Chinese loans, coupled with the insistence on unfavorable terms and hidden clauses, leaves Sierra Leone vulnerable to exploitation and manipulation. The recent revelations of hidden debt and secret escrow accounts underscore the need for greater scrutiny and oversight of financial agreements with China.

As Sierra Leone seeks to chart its path to development and prosperity, it must prioritize the interests of its citizens above all else. Instead of succumbing to the allure of quick-fix loans and infrastructure projects, the government should pursue sustainable and equitable partnerships that benefit the nation as a whole. Learning from the mistakes of others, Sierra Leone must tread cautiously in its dealings with China and ensure that its sovereignty and economic future remain intact.

President Bio’s upcoming visit to China presents a critical opportunity for Sierra Leone to reassess its relationship with Chinese lenders and prioritize the long-term interests of its people. As we chart our course for growth and development, it’s crucial to recognize that entering into Resource for Infrastructure (RfI) deals with China can have detrimental effects when the host country fails to secure fair terms. Our mineral resources should serve as catalysts for the prosperity of all Sierra Leoneans, rather than burdening future generations with insurmountable debt. As a sovereign nation, and mindful of our historical experiences with mineral extraction, it’s imperative that we proceed with caution and learn from the successes of countries like Botswana, which have effectively managed their resources for national development.

We must ensure that any agreements made with China are transparent, equitable, and in the best interests of Sierra Leone as a whole. This means prioritizing the welfare of our citizens over short-term gains and establishing a governance framework that transcends the tenure of any single government. By following in the footsteps of Botswana and other successful nations, we can lay the groundwork for sustainable development and prosperity that will endure for generations to come.

It is imperative that the government engages in transparent and accountable negotiations, safeguards against predatory lending practices, and seeks partnerships that promote sustainable development and economic growth for all Sierra Leoneans. The stakes are high, but with careful planning and foresight, Sierra Leone can avoid the pitfalls of debt trap diplomacy and chart a course towards a brighter future.

Source: Sierra Eye

Post a comment

Post a comment

Comment(s)

Disclaimer: Comments expressed here do not reflect the opinions of Sierraloaded or any employee thereof.

Be the first to comment