The unveiling of Sierra Leone’s Finance Bill 2024 yesterday in Parlaiment might be heralded as a mechanism for revenue enhancement, yet beneath its fiscal provisions lies a dense labyrinth of hardship for a populace already staggering under economic duress. Championed by the former World Bank staff, Honourable Minister of Finance, Sheku Ahmed Fatamadi Bangura, the bill, set to be enacted today, holds the potential to exacerbate the prevailing hardships faced by citizens.

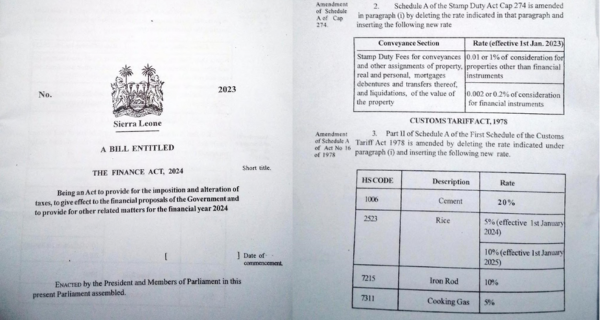

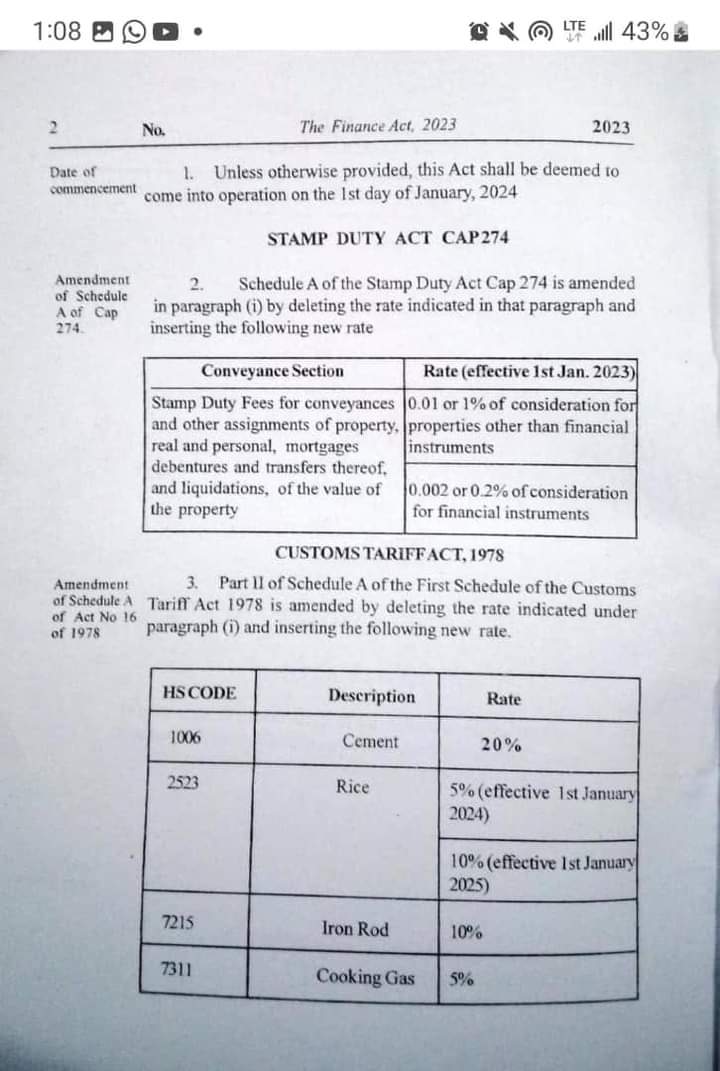

At the core of this financial overhaul is the imposition of a 5% import duty on rice, an essential dietary staple for the Sierra Leonean populace. The subsequent projected increase to 10% in the following year serves as an ominous signal of imminent financial strain for a population already grappling with economic challenges.

Further entwined within the bill’s fabric are multifaceted adjustments, including the reduction of the Minimum Alternate Tax (MAT), taxation on income derived from digital products and services, and recalibrations of various withholding tax rates. While purportedly aimed at revenue mobilization, these amendments impose an increasingly burdensome tax landscape on businesses and citizens alike.

The imposition of a 1% Education Levy, adjustments in Excise Duties, and the introduction of new levies on gambling, betting, and lottery sectors paint a canvas of financial entanglement. These measures not only restrict economic fluidity but also cast a shadow on the fundamental aspects of livelihood and social well-being.

A fundamental concern pertains to the lack of stakeholder consultation in formulating these tax amendments. The absence of dialogue with private sectors potentially blindsided the government to the adverse repercussions these fiscal impositions bear on various industries. In particular, the proposed 5% excise duty on gambling, betting, and lottery businesses could ravage these sectors, potentially causing catastrophic implications.

Moreover, the financial burden these provisions impose disproportionately affects the most vulnerable segments of society, further compounding their struggle. It’s evident that the government’s pursuit of revenue enhancement lacks a balanced consideration of the populace’s already tenuous economic standing.

The government’s assertion of these tax increases as a means for development projects stands on shaky ground. While revenue generation is indispensable for national progress, the disproportionate weight of these impositions risks plunging the nation into a cycle of financial distress. Critics have aptly labeled this bill as the ‘Hunger Act,’ highlighting its potential to exacerbate food insecurity by taxing essential food commodities.

It’s time to address the stark imbalance between the government’s fiscal strategies and the realities faced by the populace. The mantra of providing adequate, accessible, and affordable public services should not be relegated to a mere public relations gesture but treated as an indispensable responsibility.

Sierra Leone’s economic future should not be shackled by a fiscal framework that inadvertently strangles its citizens. A recalibration in policy-making, one that involves extensive stakeholder consultations, is imperative to ensure a balanced and sustainable economic future for all.

The Finance Bill 2024, in its current form, risks being a silent predator, preying upon the economic fabric of Sierra Leone. Its provisions cast a long shadow of financial hardship, impeding the prosperity and well-being of its people. It’s high time for a reconsideration and a recalibration that prioritizes the citizens’ welfare while ensuring a sustainable path for economic growth and development.

Source: Sierra Eye